The grand vision for Decentralized Autonomous Organisations (DAOs) is of industrious, utopian communities owned and managed by their members, with each individual having a voice in how assets are allocated and how things are run.

But the sad truth is that DAOs often start out centralized; in many cases, key decisions have already been made by the DAO’s core team well before the bulk of its members even join. But there’s a change in the air.

One soon-to-be-launched DAO is determined to remedy the situation, ensuring that its 10,000-strong community will be involved in key decision-making from the outset. It’s being launched by the community of DexGuru, a popular trading and analytics platform, and its members will be able to influence the shape of GuruDAO—and accompanying token—even before they launch.

DexGuru contributor Nick Sawinyh told Decrypt how the newly-formed organization will embody the true principles of decentralization—and why that’s so vital for the future of DAOs.

Not all DAOs are created equal

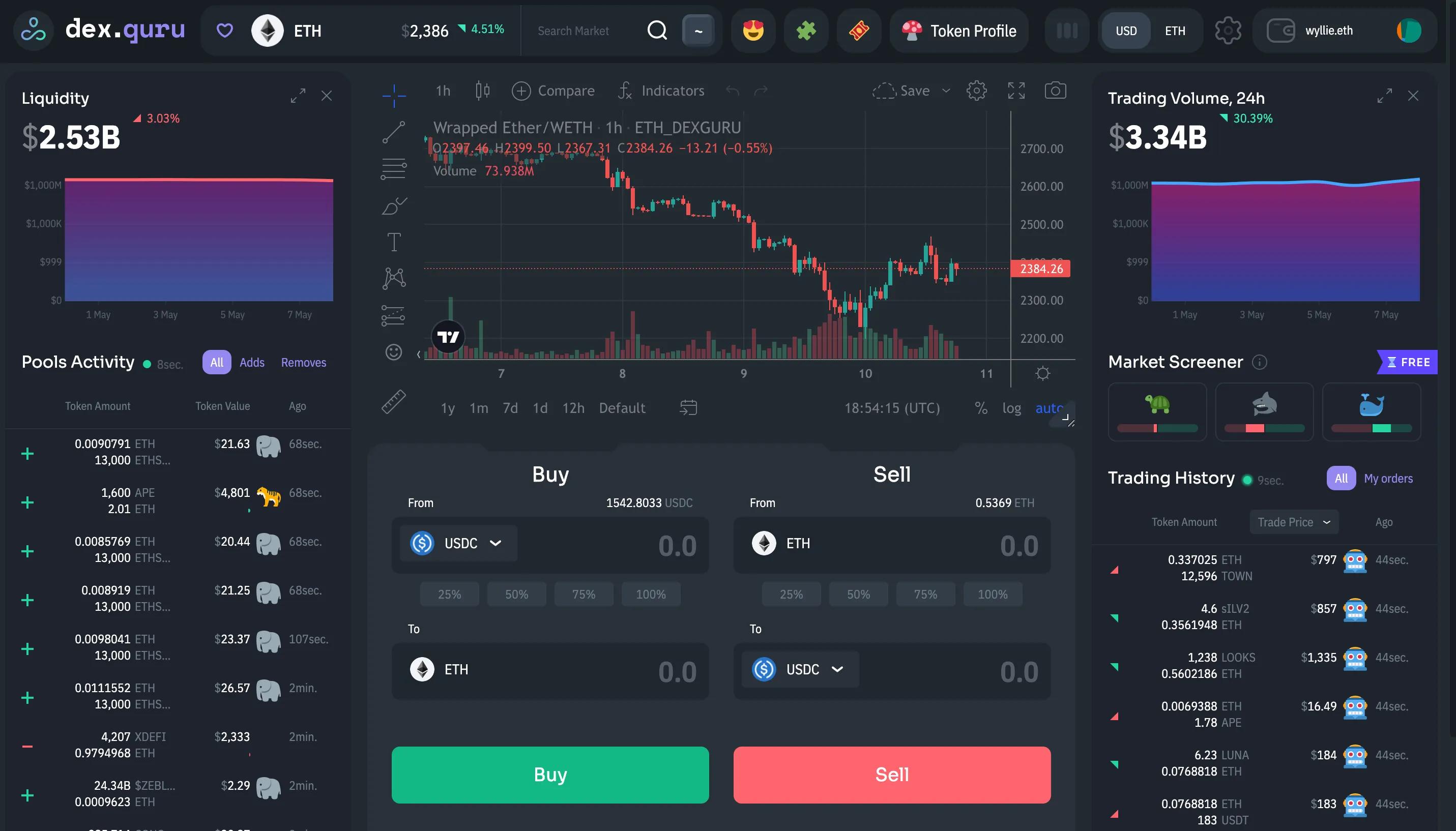

The DexGuru trading terminal launched in 2020 with the aim of providing the best user experience along with real-time data across all decentralized exchange (DEX) markets, enabling accurate on-chain research and powerful data analytics.

Like many crypto projects, it plans to launch a DAO to allow its community of users to govern the direction of the project. But even the launch date of GuruDAO is being left up to the community, said Sawinyh.

It’s an approach that’s far from typical; projects don’t usually assign voting rights to community members before their tokenomics have been determined, or give users a say in the process.

Most often, decisions on “how to launch a token, how tokenomics should work, how the internal processes of DAO governance should work… are taken by a very narrow circle of around five to 10 people from the core team,” says Sawinyh.

“We want our community to define these rules by ourselves, without the core team forcing their will. If we're talking about community governance, and if we're talking about people building something together, it shouldn't be a core team or some kind of developer or support team or some inner circle, taking decisions for everyone,” he explained.

"We want our community to define these rules by ourselves, without the core team forcing their will."

Each member is equipped with a Guru Season Pass NFT that lets them participate in a process DexGuru describes as “governance mining” during the DAO bootstrap phase. (Secondhand Season Pass NFTs are available at the Opensea marketplace.)

Community members will vote on “how the DAO will operate, how the token will work, and what the token allocations will look like,” among much else, says Sawinyh.

The DexGuru story

This rapid, early decentralization reflects DexGuru’s broader mission of bringing on-chain data analytics tools to a wide community of decentralized finance (DeFi) traders, enabling them to make the same informed decisions as large-scale traders, and effectively decentralizing the distribution of on-chain analytics.

GuruDAO is formed “from the huge number of people coming to the DexGuru site for charting, to trade tokens and search markets,” says Sawinyh, who has extensive experience in building consumer-facing crypto products, and previously founded internet publication DeFiPrime.

He and a couple of friends set up DexGuru during the DeFi summer of 2020, becoming “obsessed” with the idea of providing better UX and tooling for their growing trading community.

“Most of the charting tools at the time supported only Uniswap, and we wanted to chart every token on every possible chain, without any middleman, without any interruption, and we wanted to see data as fast as possible—in real time,” says Sawinyh.

Time flies when you’re having fun! With spring 2022 coming to a close, we'll dive into what we’ve been up to for the last few months

✅ Updated UI

✅ Multichart

✅ ENS

✅ Improved performance

⤵️https://t.co/wLCALiKWm2— DexGuru 🧘♂️ (@dexguru) May 31, 2022

The platform’s primary mission became to develop professional-grade charting tools and real-time market data for any token and decentralized exchange hosted on an EVM-compatible chain. They sought to provide an overview of the entire market and its major stakeholders, enabling traders to easily monitor on-chain flows of assets, with data transparency as a guiding principle.

Recent updates include a Token Profile feature that uncovers new details, such as the top 100 holders and whether they’re still in profit, as well as “Trader Profile,” which allows users to see the value held in a wallet, and its transaction history.

There’s also a new liquidity provider classification, which tracks and tags investors based on the value of funds locked inside various liquidity pools within the past 30 days.

And their strategy is proving successful: in February 2022, DexGuru closed a $5 million strategic funding round; since its launch, the platform has processed over $1 billion in trading volume.

A bootstrapped DAO launch

The rapid growth of the DexGuru community, which now forms the foundation on which GuruDAO will build, has been extraordinary because of its organic nature, says Sawinyh. Now, it’s up to the community to decide the time, date, and design to be used to launch the GuruDAO and its token.

In-depth GuruDAO Bootstrap Guide with all questions covered ⤵️ https://t.co/zeqZQ5XLpe

— DexGuru 🧘♂️ (@dexguru) March 31, 2022

“I think what we're seeing now—not just with DexGuru, but as a growing trend—is a sort of 'day 0' decentralization, where all formative decisions (including token distribution) are ceded to the DAO, while the operating team acts more as a sub-DAO than project overlords,” said Dino Ibisbegovic, a GuruDAO member who’s part of Daedalus, an angel collective that's invested in DexGuru.

Once the DAOs mechanics and token allocations have been decided—with each voting cycle taking around a week, according to Sawinyh—GuruDAO will use smart contracts and tokens, like other DAOs.

"What we're seeing now—not just with DexGuru, but as a growing trend—is a sort of 'day 0' decentralization."

Its participants will make decisions on how the organization's resources are allocated; they will decide how to reward early governance participants, airdrops and transactions made by the DAO.

And while the token launch is eagerly anticipated by the GuruDAO community, current market conditions—namely, issues with UST and market turbulence—mean that the community is likely to wait a couple of months before launching its token, says Sawinyh.

In the meantime, they plan on improving the DAO’s tooling and further building out the community, defining, refining and further decentralizing as they go.

Sponsored post by DexGuru

Learn More about partnering with Decrypt.