Coinbase shares on the rise

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$65,481.00

3.54%$1,916.72

4.92%$1.38

3.59%$601.94

2.25%$0.999903

0.00%$82.68

7.89%$0.286449

2.16%$1.034

0.24%$0.0935

2.47%$48.95

3.16%$0.269877

4.87%$0.999907

-0.00%$492.74

2.27%$8.68

9.51%$26.85

1.13%$338.92

6.19%$0.161987

1.56%$8.60

5.13%$0.999198

0.05%$0.154534

3.46%$1.00

0.14%$0.00934515

-6.69%$0.0981

5.23%$1.00

0.02%$53.23

4.59%$240.80

3.27%$8.76

5.90%$0.00000601

1.52%$0.893612

4.15%$1.29

-2.47%$0.114357

6.40%$0.075707

1.98%$5,164.47

0.25%$1.44

2.77%$5,199.37

0.14%$3.54

6.80%$1.32

6.32%$0.600676

3.38%$1.00

0.00%$118.25

4.56%$0.997426

0.02%$0.696068

0.59%$176.51

6.53%$0.000004

2.45%$0.999842

0.00%$1.12

0.00%$75.61

3.29%$0.999865

0.00%$2.22

1.02%$0.165487

2.00%$0.066417

4.74%$0.00000165

0.92%$8.51

4.21%$0.999453

0.02%$1.015

4.30%$0.25683

5.42%$0.114311

8.59%$2.19

6.75%$11.00

0.03%$0.405456

10.50%$6.90

3.31%$8.56

4.76%$0.00175324

0.01%$2.06

0.63%$0.057392

-0.56%$65.29

4.12%$0.01701049

-3.09%$0.835385

2.63%$0.101448

7.16%$0.999972

0.02%$3.43

5.38%$1.23

0.02%$0.00934218

4.42%$0.02942677

0.07%$0.768152

-1.69%$0.086347

3.76%$114.40

0.01%$0.999897

0.03%$1.41

4.84%$1.027

0.01%$1.11

-0.19%$0.918872

5.02%$0.860856

6.87%$0.03336012

-0.64%$1.80

15.38%$0.00728427

1.77%$0.080176

0.08%$1.095

0.01%$0.998216

-0.02%$0.094095

3.31%$1.00

0.04%$0.0290827

-0.35%$0.00000594

3.03%$0.01294753

-0.46%$0.999171

0.03%$27.98

3.10%$0.148742

4.83%$0.262551

6.30%$1.087

0.05%$0.713275

22.82%$0.999943

0.03%$1.18

-0.03%$0.250442

8.02%$0.067998

4.72%$33.79

7.01%$0.00674468

7.19%$1.27

6.61%$0.376218

2.25%$0.04585644

0.88%$166.57

-0.16%$0.999903

0.08%$0.501881

12.36%$1.035

3.08%$0.157578

3.74%$0.240351

9.96%$0.080516

4.47%$0.03402182

0.05%$1.39

1.40%$1.019

-0.05%$0.999703

0.00%$0.00000033

0.06%$0.00000033

1.42%$123.77

4.76%$16.07

8.07%$0.054733

4.66%$3.21

0.66%$0.01654768

1.04%$3.20

2.12%$0.331621

8.46%$1.49

-0.62%$0.051966

4.42%$0.06797

3.84%$0.993297

-0.58%$0.02655031

3.57%$0.00575621

3.47%$0.30105

9.83%$0.316475

7.42%$0.00002886

4.15%$0.990176

-0.25%$0.373149

25.45%$17.18

1.25%$0.227382

15.55%$0.075079

12.96%$1.61

-1.93%$0.306268

4.22%$0.04989532

4.01%$1.37

1.73%$0.118573

1.73%$0.136574

3.30%$0.00247875

0.94%$0.00256588

2.75%$6.14

3.44%$0.9994

-0.01%$0.04191712

3.72%$1.30

7.58%$0.999993

-0.00%$0.02020002

0.15%$1.75

4.31%$0.98842

0.02%$1.075

0.01%$0.08119

4.35%$1.00

0.02%$0.511426

3.62%$1.28

8.20%$22.79

0.00%$0.00211181

3.22%$0.098145

0.59%$5,297.81

2.26%$0.00000095

-0.11%$0.08891

4.10%$0.198982

0.40%$0.200575

7.05%$0.00003563

1.71%$0.052968

3.04%$1.00

0.00%$2.66

1.45%$0.183595

0.17%$9.35

8.91%$0.01994091

6.08%$0.077623

0.70%$0.120917

5.54%$0.179607

21.40%$0.092927

3.27%$1.00

0.00%$0.00481553

2.24%$4.01

20.50%$18.19

6.91%$0.768331

0.94%$0.02364426

1.43%$1.001

0.08%$1.83

6.14%$2.09

2.64%$0.00352895

2.48%$0.02022207

-0.56%$1.79

0.09%$0.607643

4.79%$48.00

0.03%$0.051771

4.97%$2.03

6.39%$0.995689

0.11%$1.26

0.64%$3.35

-0.86%$0.156312

10.33%$0.00000764

3.36%$0.04001055

2.92%$0.998488

0.08%$0.99803

-0.23%$0.711373

17.21%$0.14874

-0.63%$1.014

0.10%$0.166209

9.03%$0.314007

0.43%$0.303481

-0.64%$0.399736

4.17%$0.653149

5.33%$0.621734

7.43%$0.076085

3.51%$0.02308737

-16.23%$0.080787

5.31%$1,097.66

0.01%$4.46

5.54%$0.295233

5.47%$0.319761

0.45%$0.257192

2.46%$0.091058

5.26%$0.127934

1.95%$1.94

5.91%$0.125228

-4.48%$0.362104

2.65%$0.130774

-0.20%$0.252381

4.91%$0.220489

0.25%$0.00146088

1.10%$8.12

-6.23%$0.075625

5.02%$0.995008

0.03%$0.00396732

2.82%$1.001

0.00%$10.90

-8.96%$0.117955

-3.33%$2.37

6.62%$0.999669

0.02%$0.990637

-1.76%$0.193552

7.22%$0.111486

17.86%$1.44

-0.94%$1.062

0.01%$11.82

-3.88%

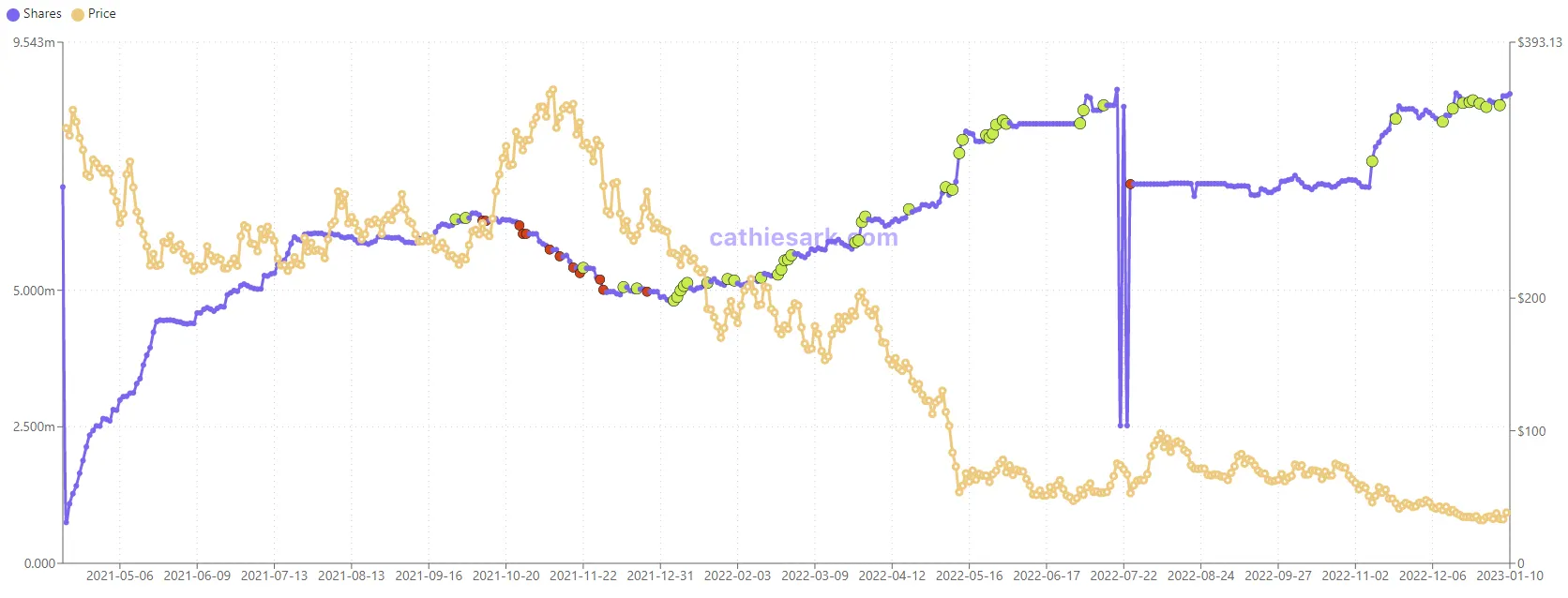

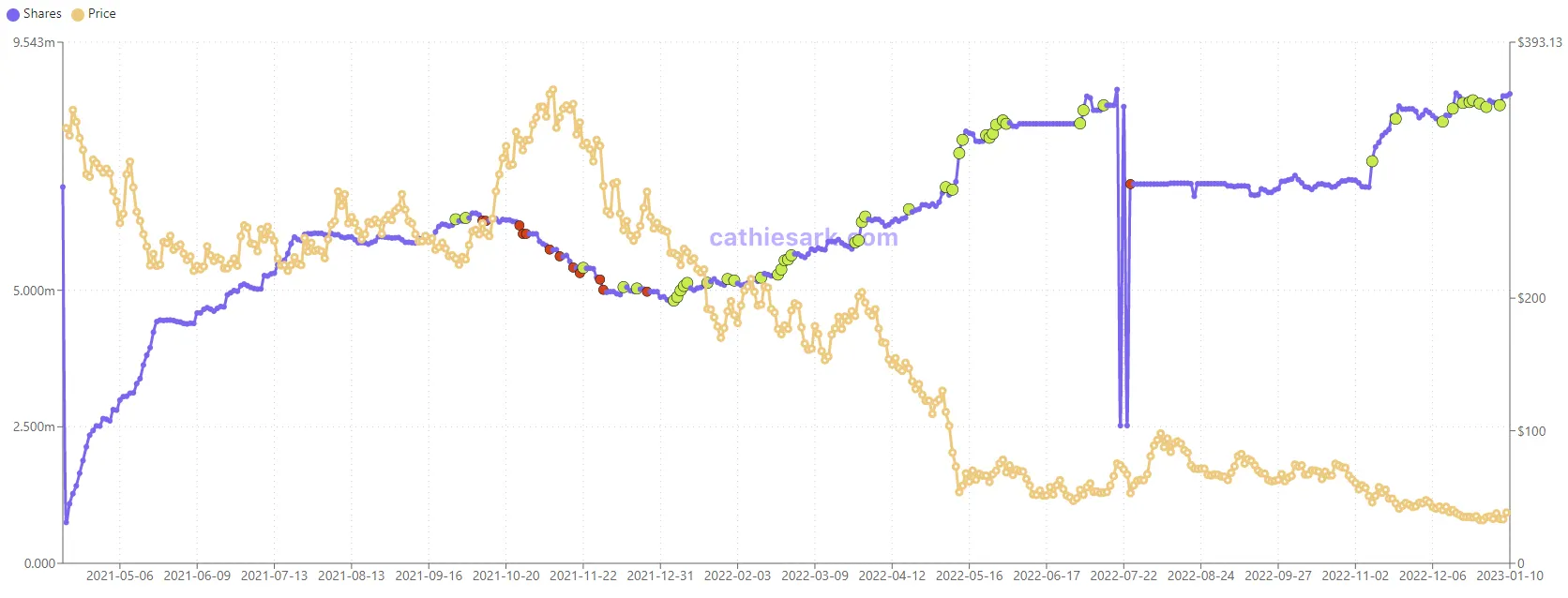

Ark Invest, the investment firm led by Cathie Wood, purchased another 33,756 shares in crypto exchange Coinbase (COIN), on Tuesday, according to an investor email seen by Decrypt.

The purchase is worth roughly $1.45 million based on COIN’s price of $43.23 at press time, with the shares allocated to the ARK Innovation ETF (ARKK) fund.

Yesterday’s purchase marks the firm’s second over the last week. On January 5, Ark added 172,276 shares of Coinbase to two of its funds, ARKW and ARKF.

Ark’s ARKW fund actively invests in internet-based products and services, cloud computing, artificial intelligence, e-commerce, and media innovations.

In contrast, the ARKF fund focuses on fintech companies which Ark has defined as having long-term growth potential.

Since December 14, 2022, Ark has bought as many as 750,324 shares over eleven different trades.

Ark holds nearly 8.596 million COIN shares across its three funds, ARKK, ARKW, and ARKF, representing 2.92% of the firm’s total investments.

According to Cathiesark.com, the investment firm’s average share cost is as high as $240, nearly 82% higher than the current trading price, adversely affecting the fund’s performance.

Yesterday, Coinbase (COIN) shares jumped nearly 12.96% from $37.80 to $43.23, per data from Nasdaq. On a weekly note, COIN is up 24.98%.

Coinbase’s bullish price action is primarily attributed to the company’s decision to let go of 950 employees, cutting down the company’s operating costs by about 25%.

Despite hefty 30% gains since the new year, COIN is still down 87.23% from its historical all-time highs of $342.98 in November 2021.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.