👀📈#BTC and #ETH 90-day #volatility just dropped to multi-year lows at 35% & 37% each, making them less volatile than oil at 41%.🤔🗓️ pic.twitter.com/VMfTW53goG

— Kaiko (@KaikoData) August 16, 2023

$90,242.00

1.06%$3,111.92

3.17%$2.07

1.48%$898.76

0.95%$0.999787

-0.00%$135.57

3.50%$3,107.07

3.04%$0.283549

-0.40%$0.142847

2.90%$0.43517

3.12%$1.02

0.00%$60.82

0.89%$3,793.32

3.05%$587.99

1.30%$89,912.00

1.01%$3,374.46

3.11%$13.74

1.36%$0.999576

-0.02%$9.75

1.29%$0.999364

-0.06%$3,106.68

3.48%$29.64

2.40%$3,364.93

3.53%$0.242622

2.77%$373.62

0.63%$0.999275

0.14%$410.93

21.13%$90,005.00

0.95%$83.49

2.74%$1.61

3.26%$13.57

1.54%$0.135097

2.67%$0.00000848

1.32%$1.001

0.06%$1.083

0.45%$0.152863

2.81%$1.64

3.56%$0.103517

0.74%$0.999446

-0.02%$1.21

0.04%$1.12

2.60%$5.58

1.82%$2.13

0.95%$192.42

3.39%$292.10

5.48%$0.998821

-0.04%$0.075295

20.56%$3.55

0.48%$110.76

3.16%$1.76

4.38%$4,182.56

-0.19%$0.998836

-0.05%$1.26

2.17%$0.275597

6.06%$13.40

2.71%$1.00

0.00%$0.00000484

9.69%$0.951997

3.15%$168.61

3.29%$3,104.18

2.75%$3.44

0.76%$0.219561

-0.41%$0.00762446

2.22%$0.00307304

3.44%$135.60

3.50%$4.69

1.63%$0.00000162

-1.21%$0.476088

3.97%$0.02853063

13.44%$1.14

0.01%$4,195.05

-0.31%$0.59468

4.29%$0.052384

1.72%$0.99975

-0.01%$10.21

1.18%$0.999143

-0.02%$0.12415

2.13%$1.77

3.01%$1.11

-0.00%$1.11

-0.10%$3,570.86

3.44%$0.999324

-0.05%$88.92

0.06%$0.999997

0.01%$0.053547

0.90%$10.38

1.39%$895.81

0.88%$0.212331

3.91%$0.134132

1.21%$147.50

3.53%$5.73

1.93%$3,285.71

2.81%$1.50

3.75%$0.01259879

1.50%$2.23

2.32%$90,198.00

0.69%$1.002

0.43%$0.01301452

0.06%$3,325.31

3.60%$90,007.00

0.97%$90,140.00

0.92%$0.970758

-1.48%$0.049636

0.93%$10.92

0.01%$0.131527

1.90%$1.61

2.25%$0.997707

-0.04%$29.80

2.29%$0.00000954

2.93%$2.30

2.97%$113.54

0.00%$3,311.86

3.58%$1.016

0.00%$3,360.49

3.15%$0.01155911

3.62%$90,039.00

0.94%$0.227554

3.21%$2.16

1.50%$90,465.00

0.33%$1.094

-1.33%$0.999914

0.01%$156.12

3.26%$1.21

-1.39%$1.00

-0.05%$0.99998

0.01%$3,185.29

3.59%$0.669488

4.56%$0.237698

2.00%$0.321249

5.28%$0.667009

0.82%$3,101.80

3.02%$0.086299

1.63%$47.67

6.02%$0.397297

2.97%$5.66

4.03%$2.93

-1.39%$89,781.00

0.73%$0.839946

0.61%$5,514.69

7.79%$0.999015

0.43%$0.300039

2.32%$0.598927

4.04%$0.110638

-1.76%$0.99991

-0.02%$0.482814

1.60%$3,107.69

3.40%$0.00531285

1.12%$0.827244

5.12%$0.588313

4.65%$3,102.06

3.14%$0.99729

-0.01%$2,460.42

0.00%$0.04619687

1.81%$1.002

0.50%$0.00531205

0.19%$181.84

3.31%$0.00004994

8.63%$3,344.99

3.20%$1.21

-0.18%$0.132429

5.78%$0.07758

0.39%$0.999916

0.10%$3,277.72

2.78%$11.31

3.23%$0.103393

2.14%$1.11

0.02%$0.999133

-0.13%$3,401.13

3.26%$0.00000042

-0.78%$0.02128777

-0.32%$0.414561

-28.98%$0.996116

0.17%$0.02231947

-16.58%$20.09

-0.20%$0.398642

3.00%$90,449.00

1.49%$0.069424

2.29%$3,443.86

3.16%$0.391814

5.86%$2.38

-0.18%$90,454.00

0.00%$0.03869885

-1.23%$0.253222

2.22%$22.82

0.47%$0.072941

2.63%$3,106.45

3.57%$21.76

4.61%$90,021.00

0.78%$0.141196

0.58%$0.142624

2.57%$0.346701

-0.61%$0.00000036

0.38%$1.94

-0.69%$0.095791

4.34%$0.0071576

6.18%$1.16

0.13%$0.211666

-4.78%$0.00736246

4.24%$0.341562

2.54%$16.72

1.32%$126.00

1.26%$0.16719

0.18%$0.999346

-0.03%$0.094085

2.43%$3,361.55

3.00%$134.29

-2.88%$0.03138197

1.30%$0.997866

-0.36%$29.60

2.51%$1.14

1.96%$3,064.13

2.91%$0.305895

-0.30%$0.259847

-7.85%$3,364.42

3.31%$0.02757449

5.60%$30.93

1.38%$1.088

0.00%$90,066.00

0.89%$4.13

1.72%$0.151544

1.01%$3,101.38

2.74%$0.180109

0.98%$1.002

0.39%$950.90

1.00%$26.13

-1.99%$0.994066

0.10%$1.39

1.13%$0.00005109

-2.10%$0.03252278

0.06%$0.00280626

0.58%$90,061.00

0.65%$1.00

0.00%$4.04

3.61%$0.111916

1.77%$1.002

0.31%$3,110.97

3.07%$0.277344

6.07%$0.00000122

0.49%$13.56

1.49%$3.26

4.76%$0.178104

-0.49%$0.238081

5.00%$0.00000122

-5.29%$2.42

3.40%$0.160256

-0.32%$0.558026

-5.67%$0.079024

1.69%$0.489049

0.99%

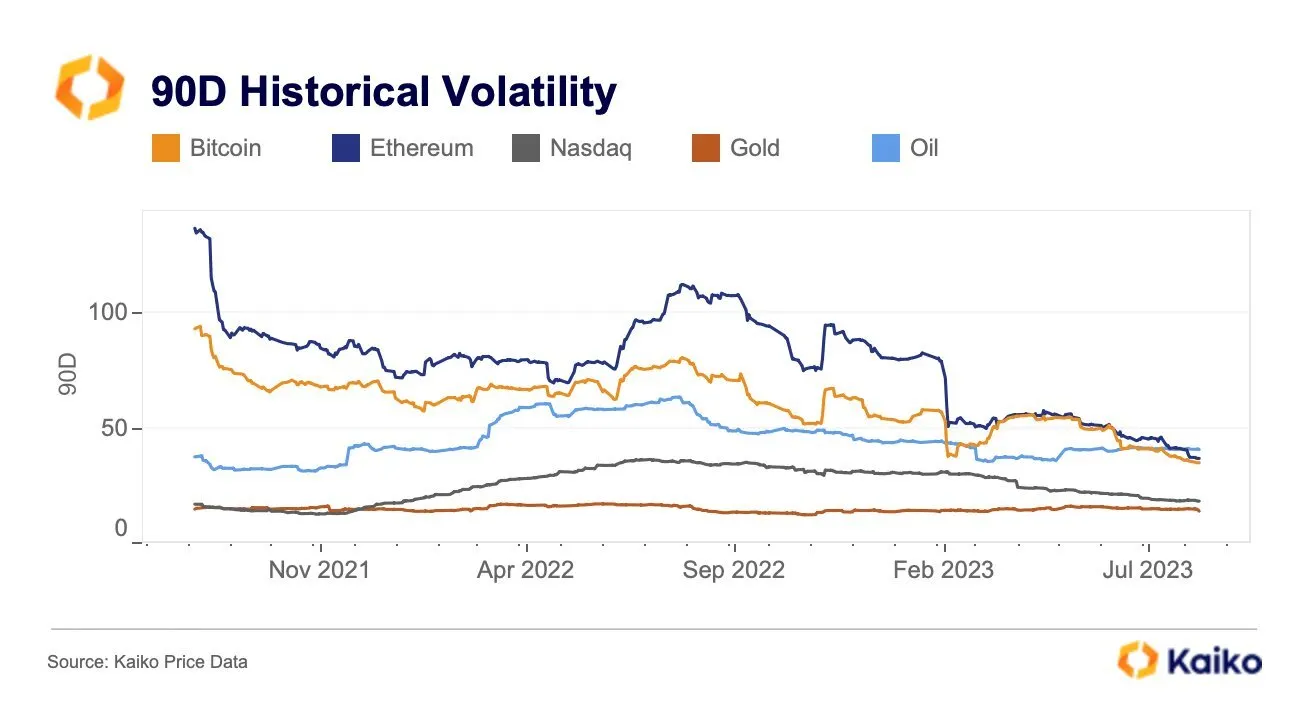

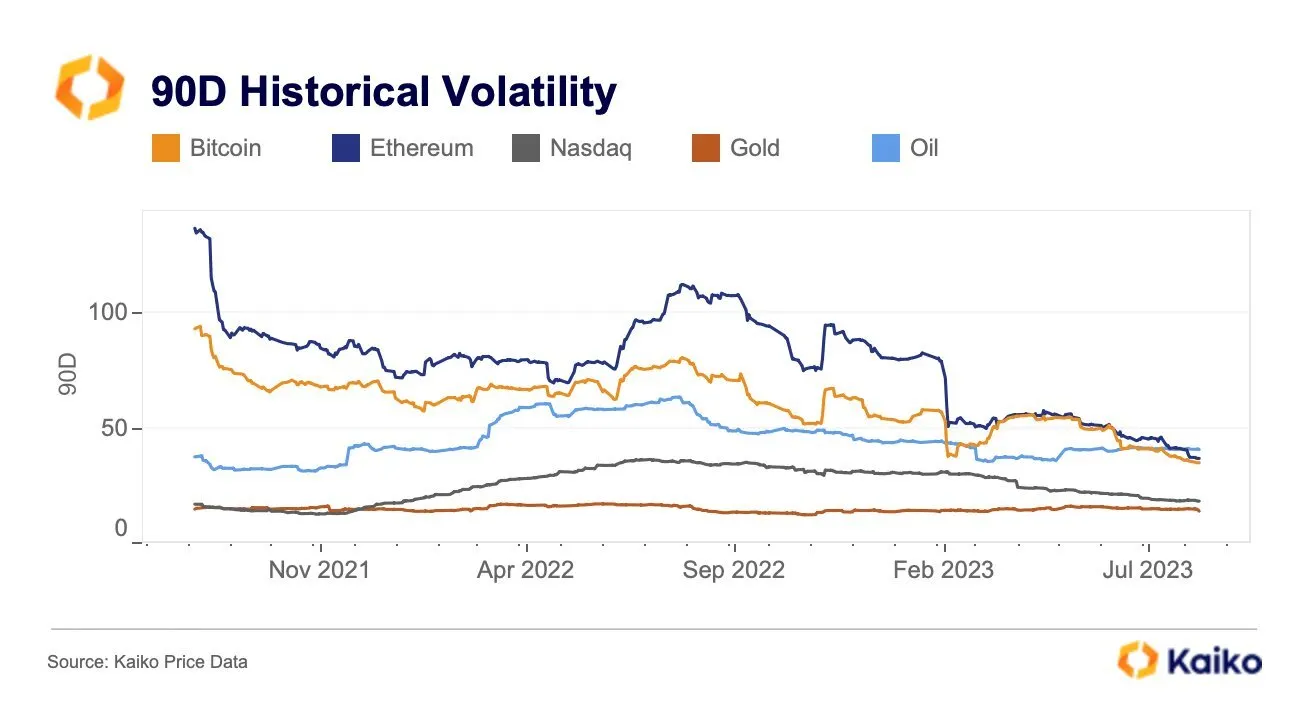

Notorious for their steep ups and downs, leading cryptocurrencies Bitcoin and Ethereum appear to be taking a summer pause.

Now, even oil has overtaken these digital assets, overtaking the two in volatility terms.

Per new data from Kaiko research, 90-day-volatility indexes for Bitcoin (BTC) and Ethereum (ETH) have hit multi-year lows, dropping 35% and 37%, respectively.

This now makes the top digital assets less volatile than oil, which sits at 41%.

Market volatility is the frequency and magnitude of price movements, up or down. It is calculated by how much a price varies over time–with a higher percentage representing higher volatility, and vice versa.

Cryptocurrencies have historically been more volatile than oil, which is seen in the larger frequency and magnitude of their price movements, triggering Kaiko analyst Dessislava Ianeva to call the current market “unusual.”

That said, this volatility has declined substantially according to the Kaiko analyst, as “Bitcoin as an asset continues to mature.”

Although oil is currently leading volatility among assets measured—which include the Nasdaq and gold— it has dropped since last year.

Ianeva aid that oil’s volatility has fallen from 63% in July 2022, although it has been picking up since April.

👀📈#BTC and #ETH 90-day #volatility just dropped to multi-year lows at 35% & 37% each, making them less volatile than oil at 41%.🤔🗓️ pic.twitter.com/VMfTW53goG

— Kaiko (@KaikoData) August 16, 2023

A driver, she told Decrypt, seems to be an increase in geopolitical tension as well as a “disappointing reopening” by China.

The country had imposed stringent Covid-19 restrictions up until recently, but lifting those restrictions hasn’t had the bullish economic jolt that many expected.

Kaiko’s research also shows that Bitcoin and Ethereum sit at multi-year lows in terms of liquidity and trade volume, says Ianeva.

This could also be driving the reduced volatility and oil’s surprising lead.

For Ianeva, these figures have a two-tiered answer. She told Decrypt on the one hand it’s likely due to the “traditionally slow summer months.” On the other, it is the “market looking for a narrative.”

A spot Bitcoin ETF–which Ianeva reckons is “still months away”–could swing things back into the market's favor.

This doesn’t seem far-fetched after BlackRock’s surprising application, a firm that also enjoys an impressive track record for application approval, and the subsequent moves by other applicants.