FTX engaged BlackRock and Google as potential investors while Sam Bankman-Fried’s crypto exchange circled the drain last November, according to evidence submitted in the one-time wunderkind’s criminal trial on Thursday.

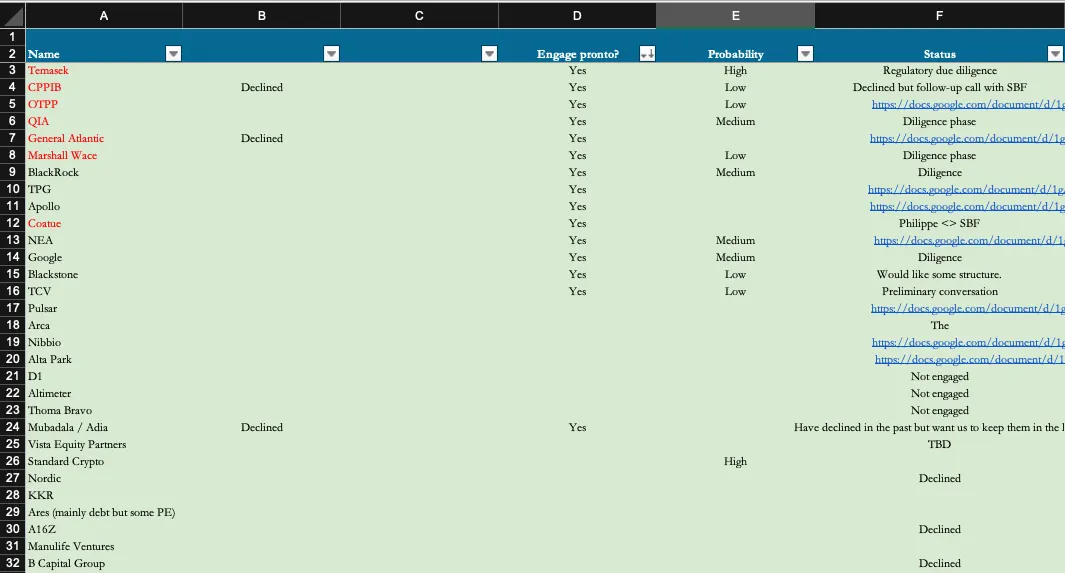

Federal prosecutors offered a spreadsheet maintained by the now-defunct exchange connected to its fundraisers as FTX’s former general counsel, Can Sun, testified. The document includes info about various fundraising rounds—including one that Sun said “never closed.”

According to his testimony, FTX’s C1 funding round began in the “late summer and fall of 2022.” The spreadsheet indicates that 15 potential investors should be “engage[d] pronto,” including BlackRock, Google, and Apollo, which Sun spoke about specifically during his testimony.

“They asked for Apollo [...] to invest in FTX to help solve a liquidity problem that FTX had for customer withdrawals,” Sun recalled, adding he was involved in discussions with the firm.

There was a “medium” chance that BlackRock and Google would participate in the funding round, the spreadsheet indicates. It also states that both firms were conducting due diligence on Bankman-Fried’s exchange before it collapsed on November 11.

Bankman-Fried is defending himself against seven fraud and conspiracy charges as a result of his conduct at FTX. Bankman-Fried stands accused of defrauding customers by using billions worth of customer funds for loans to insiders, political donations, venture investments, and buying real estate. He’s also accused of misleading FTX’s investors, which is now the subject of an SEC lawsuit.

According to the spreadsheet, there was an equal chance that Google, BlackRock, venture capital firm NEA, and Qatar Investment Authority would participate in the funding round. The spreadsheet lists Temasek and Standard Crypto as “high” probability investors.

BlackRock invested $24 million in FTX before it went bust, CEO Larry Fink said at a New York Times DealBook event last year. Google never directly invested in Bankman-Fried’s companies, but shares a cap table with him. In February, Google announced a $400 million investment in AI startup Anthropic, which Bankman-Fried’s trading firm Alameda Research has also backed.

Neither BlackRock nor Google immediately responded to a request for comment from Decrypt.

The spreadsheet shown to jurors this week indicates that six firms, including a16z and General Atlantic, “declined” to participate in the mid-2022 funding round. Listed just under Columbia and Harvard, the spreadsheet shows Vanderbilt University had committed $5 million to the round.

Vanderbilt University did not immediately respond to a request for comment from Decrypt.

Still, Sun said on Thursday that the funding round never closed, and “investors did not actually put money into FTX” as part of the exchange’s failed C1 funding round.

Former Alameda CEO Caroline Ellison, who has pleaded guilty to several charges in connection to the disgraced crypto mogul’s case, testified that Bankman-Fried “would try to raise capital by selling FTX equity” to get more money in October 2022.

Although it’s not reflected in the spreadsheet, Ellison said that Saudi Arabia Crown Prince Mohammed bin Salman considered buying equity in FTX, according to conversations she had with Bankman-Fried. Apparently, she added during testimony, it did not work out.

Earlier in Bankman-Fried’s criminal trial, Matt Huang, co-founder of Paradigm, spoke about a $278 million investment in FTX that the firm has “marked to zero.” Huang said if Paradigm had known about Alameda’s ability to FTX customer deposits, it would have given the firm pause.

“It was generally understood that customer deposits are sort of sacred,” he said. “To the extent that wasn't true, we would want to know more. And without knowing more, it would be a problem for an investment.”

Edited by Stacy Elliott.