Bitcoin miner Marathon Digital Holdings reported a significant loss for the second quarter of this year, citing the impact of Bitcoin’s halving event on its operations as rivals posted similar results.

The Fort Lauderdale, Florida, firm faced a substantial net loss and decreased Bitcoin production amid rising operational challenges, according to its latest quarterly figures.

The Bitcoin halving event in April, which typically occurs approximately every four years, effectively slashed the reward miners receive for processing transactions by half, rocking the sector as miners have struggled to navigate the change.

Financially, the quarter was challenging. Marathon reported a net loss of $199 million, or $0.72 per diluted share, a stark contrast to the $9 million loss reported in Q2 2023. Marathon’s share price fell 7.8% to $18.14 amid a broader market slide driven by overheated tech stocks.

Its loss was largely driven by a $148 million fair market value drop in digital assets. Analysts had forecasted an earnings-per-share of -$0.19 but missed by $0.53, according to Market Beat data.

EPS indicates how much profit a company generates for each share of its stock. Higher EPS generally suggests better profitability and is often used by investors to gauge the financial health and performance of a company.

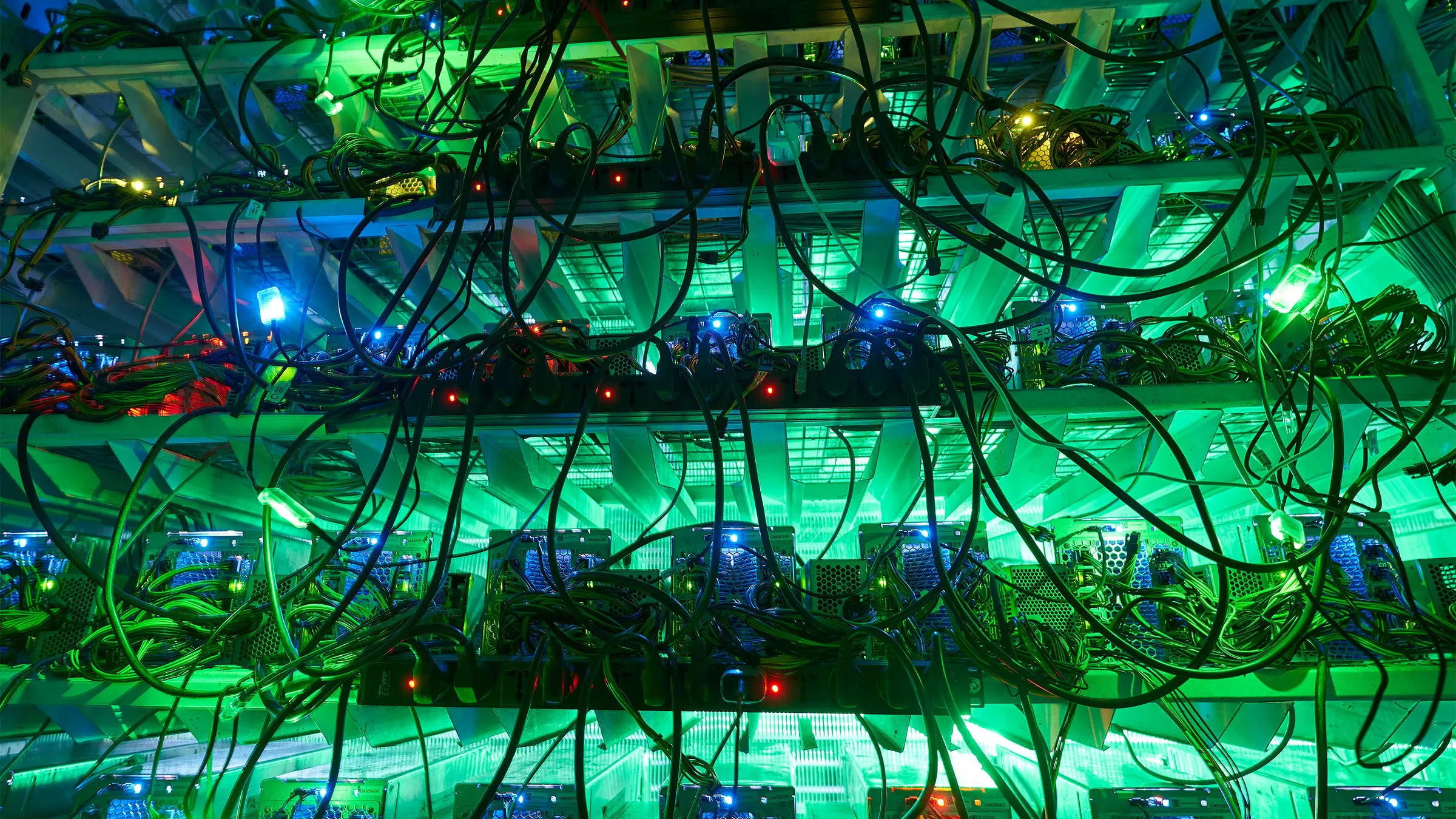

This year’s halving, coupled with increased global hash rates and equipment failures, significantly affected Marathon Digital's output, leading to a 30% decrease in Bitcoin production to 2,058 BTC compared to the same quarter last year at 2,926 BTC.

Fred Thiel, Marathon’s CEO, acknowledged the difficulties in a statement, citing unexpected equipment failures and maintenance issues at their Ellendale site, as well as the intensified competition in the mining sector.

Despite its setbacks, Thiel said the company had completed remediation efforts at Ellendale and attained a record-high installed hash rate of 31.5 exahash per second.

Revenue increased by 78% to roughly $145 million, attributed mainly to a higher average price of Bitcoin mined and revenues from newly acquired hosting services.

However, Marathon said these gains were insufficient to offset the lower production volumes and the substantial fair value losses.

Marathon is not unique in reporting lower Bitcoin production as the earnings season begins to show competitors have tripped during the first full financial quarter following the halving event.

On Wednesday, Bitcoin miner Riot Platforms also reported a net loss of $84.4 million, primarily driven by a 52% year-over-year decline in the number of Bitcoin mined between April 1 and June 31.