In brief

- Analytics firm Coin Metrics has a new way to weed out fake data from crypto volume metrics.

- Only 13 crypto exchanges can be trusted to provide accurate volume figures, according to the firm's new framework.

- Coin Metrics' Trusted Volume Framework aims to create a more transparent view into crypto markets.

The team at crypto analytics firm Coin Metrics has architected a new framework for evaluating how reliable exchange volume data really is. And based on the firm's methodology, real crypto trading volumes are close to one tenth of those reported by most exchanges.

The Coin Metrics Trusted Volume Framework is a new way to more accurately measure trading volumes across crypto markets. Many exchanges, particularly those which list illiquid altcoins, have a reputation of falsifying volumes in a bid to attract traders.

“Exchanges are especially notorious for boosting volume numbers in order to game ranking sites or other nefarious reasons,” Jon Geenty, a data scientist at Coin Metrics, told Decrypt.

“The industry is full of technical information that can be difficult to understand and at times, misleading. We are working to create a more transparent environment for those within it and a safer, more trustworthy source for those hoping to learn more.”

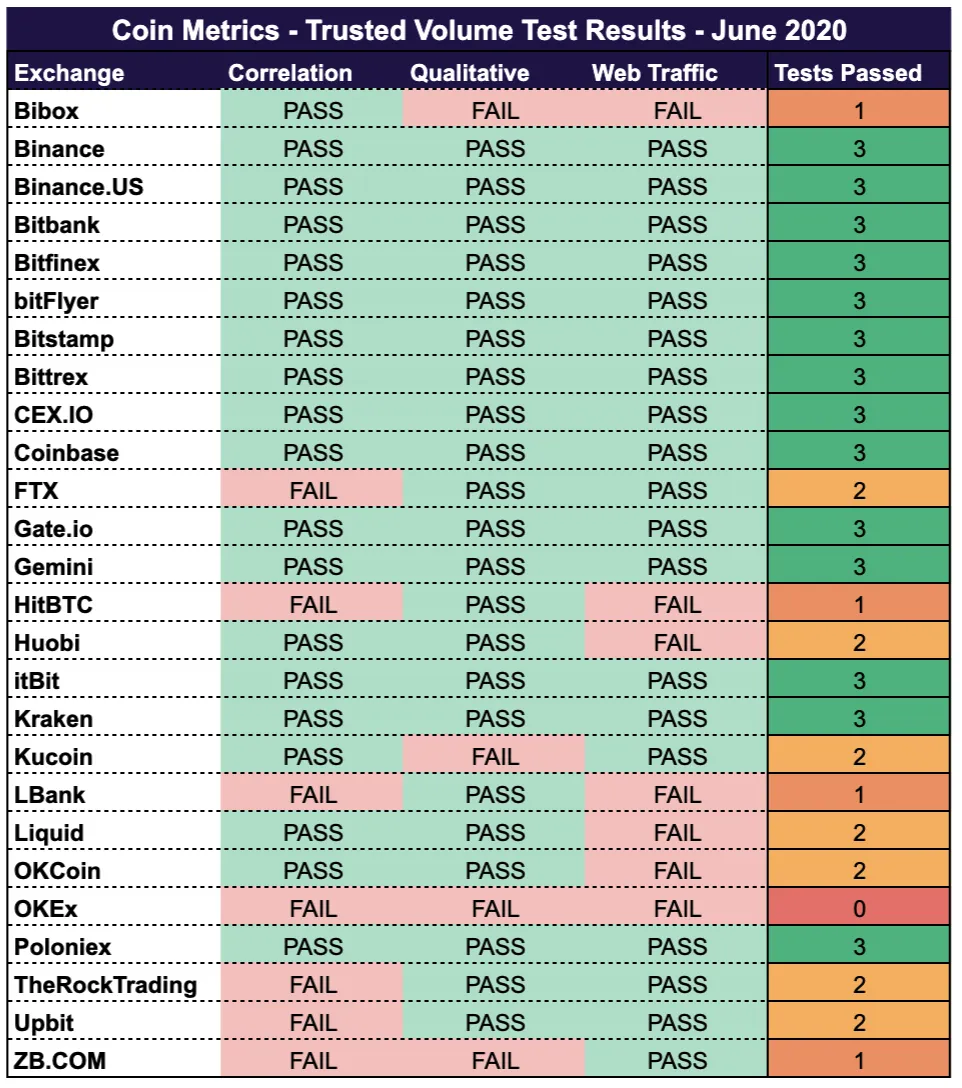

Instead of aggregating volumes from the most popular exchanges in the industry, Coin Metric’s new framework funnels data from 13 trusted spot exchanges: Binance/Binance US, Bitbank, Bitfinex, bitFlyer, Bitstamp, Bittrex, CEX.IO, Coinbase, Gate.io, Gemini, itBit, Kraken, and Poloniex. All of these exchanges, sans CEX.IO and Gate,io, Bitbank, were also included in Messari’s “Real 10” exchange index that it unveiled in March 2019.

For its own framework, Coin Metrics subjected popular crypto exchanges to a three-pronged litmus test for volume correlation, web traffic analytics and qualitative features.

The first metric measures whether or not an exchange’s price feeds are closely correlated with the price feeds from well established, well-regulated exchanges, namely Bitstamp, Bittrex, Coinbase, Gemini, itBit and Kraken. Any exchange which had a correlation of 80% or higher passed this test.

The second test involves cross referencing an exchange’s reported volume with its daily web traffic. The rationale here is that “[a]n exchange inflating volume numbers should tend to have a higher ratio of volume to traders relative to the other exchanges,” according to Coin Metrics.

For the final test, Coin Metrics gauged a number of qualitative measures regarding an exchange’s features, including historical data availability, regulation status, KYC requirements, and fiat deposits enabled. Any exchange which did not score at least a 50 out of 89 for this test failed it.

So which exchanges are the least trustworthy? Only one, the Malta-based OKEx, failed all three categories, while BiBox, ZB.com, LBank and HitBTC failed two. The full list is current as of July 1, but Coin Metrics will update it periodically if needed.

Based on this framework, the real 24-hour volume of the crypto market is roughly $13.25 billion, as opposed to the nearly $113 billion in volume reported by exchanges.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.