One spring day four years ago, Dan Notestein, a self-made millionaire and coder, padded down the wooden stairs to the basement of his ranch home in Blacksburg, Virginia. He sat down across from three other devs who were working on a startup called Steemit. Notestein, who was a contract worker on the project, settled in for what he figured would be just another day.

It turned out to be anything but.

The devs were building what had been billed by its co-founders, CEO Ned Scott and CTO Dan Larimer, as a new kind of social media platform. Steemit was intended to be the first social network to reward its users with cryptocurrency when they upvoted a post. The big idea was that posting—great posting, smart posting, honest posting—was super valuable content to a community. (Hence “steem,” which stood for “esteemed author.”)

Specifically, the men in Notestein’s semi-finished basement were putting the final touches on a blockchain, called Steem, and its tokens (also called STEEM) that would, in turn, gamify Steemit and create one big virtuous circle.

The blockchain was supposed to launch in a week, at the end of March. Today was only March 23, 2016.

Imagine then the crazy, wild surprise that swept through Notestein’s basement when one developer saw that the blockchain had already gone live. The mainnet was up and running; the genesis block had been verified.

"They were all angry about it, and it showed in different ways. One of the guys was so upset, I was concerned he was going to cry," Notestein later recalled.

A week later, Notestein realized that Scott and Larimer had used the surprise launch to give themselves a head start to mine 80% of the supply of Steem tokens. Typically, when a blockchain like this launches, everyone knows the launch date in advance, which levels the playing field, and can ensure that the tokens are evenly distributed among investors. But that didn’t happen here.

The pile of tokens would become known as the “ninjamined stake” on account of the fact that it was mined covertly. It would become the Chekov’s gun in the story of Steem, foreshadowing a problem that would, years later, all but obliterate one of the most interesting and vital communities ever built on a blockchain. The stake would pit the Tron Foundation’s CEO, Justin Sun, the P.T. Barnum of crypto, against an angry, activated, networked mob of thousands. Some $5 million dollars would be seized, a lawsuit would be launched and an anonymous hero would try—and fail—to save it all.

"The drama with Steem is probably the most important thing happening in crypto now."

At the end of it all, Steem would be riven in two. The Steem Wars also raised disturbing questions—about how blockchains should be governed, the role of “whales” with venal interests, and whether crypto exchanges who trade in the tokens affected have any right to get involved in these sorts of community disputes.

This is the story of Steem and its brutal fight for survival.

A secret sale and another bad beginning

Despite its awkward birth, Steemit quickly blossomed into a bustling, active community. More than a million people joined, with around 4,000 of them posting daily on everything from technical analysis to discussing Steem’s most popular game Splinterlands—“Steem Monsters.” The blockchain grew in value too, reaching a peak market cap of $1.9 billion.

In the Web 3.0 world, where very few consumer-facing projects ever get traction, Steemit was a success story.

In late 2019, Tron Foundation CEO Justin Sun, a young Chinese millionaire and outrageous marketer, best known for paying $4.6 million to dine with billionaire investor Warren Buffett, saw how valuable the burgeoning community could be to Tron, a cryptocurrency platform largely made up of gambling apps. He decided to buy Steemit with the hope of bringing the social network, its cryptocurrency and community to his Tron blockchain ecosystem. The move seemed like a clever way to expand his own growing crypto empire.

Larimer was long gone by this point, so Sun made a deal with Scott: He offered just shy of $8 million to buy the company and the ninjamined stake, according to sources with knowledge of the deal. (Sun declined to be interviewed for this story, as did Larimer and Scott.)

Though the number of tokens had dwindled and the stake now represented some 30% of the total token supply, it was easily enough to establish a massive voting share in Steem's on-chain governance system.

Sun had one condition, however: He said he would only pay 70% upfront, with the balance due once the Steem token was transferred to the Tron blockchain. His plan was to have the Steem token keep its name but run on the Tron network instead.

What happened next was a little like what occurs when Wall Street investors find out about a hostile takeover: When the deal was announced on February 14, the price of Steem tokens rose to $0.30, doubling the value of Sun’s newly acquired stash of 65 million Steem tokens—the ninjamined stake—to $19 million. It was an early, big win for Sun.

But Steem’s community smelled a rat.

“It is clear that the intention is to ‘dissolve’ Steem,” wrote community member Anthony Davis on Steemit. He argued that the community must revolt to prevent the ninjamined stake being used to “facilitate a hostile takeover with the express intent to collapse our chain to be assimilated into the Tron blockchain.”

Steemians were irked that the social network had been sold in secret. They were worried that Sun now had a huge supply of Steem tokens and were furious that he wanted to rip their token out and stick it on his own blockchain.

In particular, Steem is governed by elected “witnesses,” who are voted in with Steem tokens via its blockchain-based governance system. The top 20 witnesses with the most votes oversee the blockchain and keep things running smoothly. They felt especially proprietary about the platform. It was theirs, and they wanted to keep it that way.

So they orchestrated a secret plan—and made a massive first strike.

The Steem Rebellion begins

Imagine being Justin Sun and suddenly finding out that your 63 million tokens, worth $13 million at the time, had been frozen.

That’s what happened on February 23. The Steem community had quietly passed an “upgrade” that not only stopped Sun from voting with his coins, it prevented him from accessing them at all.

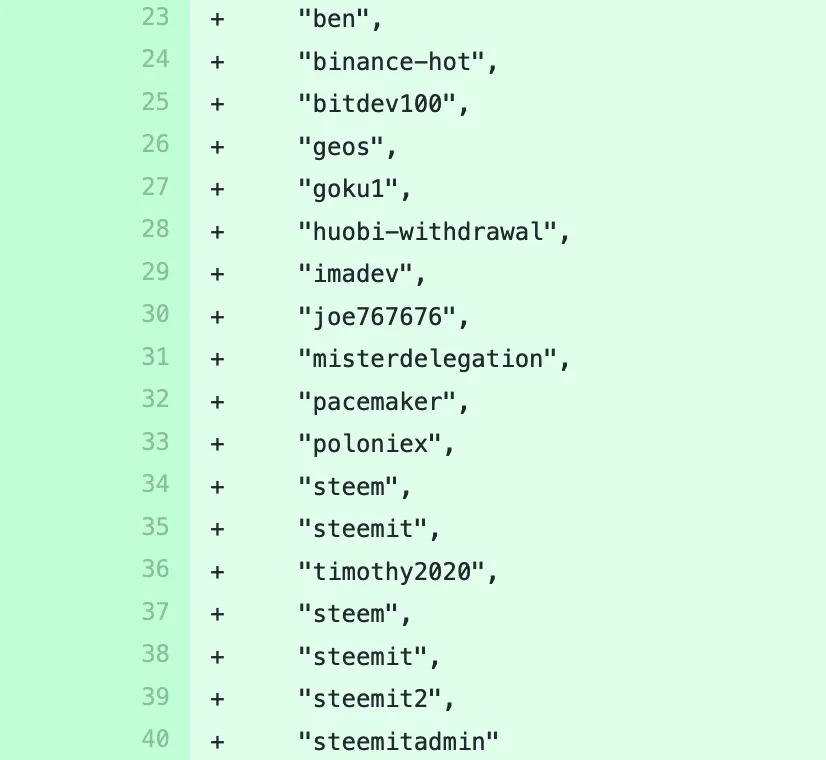

Specifically, the witnesses were able to unilaterally lock out Sun after a simple majority vote passed 19 to 1. They had orchestrated the plan in a private Slack group, ran a software upgrade on the blockchain and froze the Tron Foundation CEO’s funds.

“It was like shooting first and then talking with them,” one Steem community member recently complained to Decrypt. The person—who is actually a Sun supporter—asked that his real name be withheld because he had received death threats.

In public at least, Sun appeared to take the coup in stride. He pecked out a letter to Steem’s community the next day, asking the top witnesses to join a group call on March 6, with the intention of sorting it all out.

“I feel it is important to show you guys I am here and ready to begin building with you,” Sun wrote, amiably. “I am hoping to hear from many Steemian Witness voices to learn and understand how they think we can grow Steem together, and how Steemit Inc can communicate with the witnesses on a regular basis.”

Behind the scenes, however, Sun was working on a more cunning scheme. He had decided on a daring move that, if it succeeded, would seize control of the blockchain and rescue his riches.

The Empire strikes back

The Tron CEO started by lining up allies at some of Asia’s biggest crypto exchanges. The exchanges held huge supplies of Steem tokens on behalf of their traders, which Sun would need to reclaim the blockchain. He could use these cryptocurrency tokens to vote for his own witnesses instead of the community-run ones.

He reached out to Huobi’s operations team via WeChat, according to Huobi Vice President Ciara Sun, along with crypto exchange Binance and his own exchange Poloniex. Ciara Sun said he warned Huobi that the network was under attack, that funds had been frozen and there was a backdoor in the code that let the “attackers” freeze anyone’s funds.

Sun asked Huobi to use its Steem tokens to take over the network so he could pass a crucial upgrade to keep it safe. Ciara Sun said that he didn’t mention that the funds involved were his own.

There was, however, one tricky aspect. Steem tokens must be turned into “Steem Power” to vote for witnesses, a process that takes seconds to do and 13 weeks to unwind. As a result, the exchanges wouldn’t get their tokens back for months. Sun offered to try to make the redemption process quicker.

On March 2, they carried out the plan. Sun used the exchanges’ Steem tokens to rig the voting system, take control of the blockchain and pass an upgrade freeing his money—putting the full power of the ninjamined stake back in his hands.

He then lashed out. “#STEEM has successfully defeated the hackers & all funds are super #SAFU,” he tweeted, adding, “@SteemNetwork and @steemit community is (sic) now stronger than ever since we united & solved the difficulties!”

#STEEM has successfully defeated the hackers & all funds are super #SAFU. @SteemNetwork and @steemit community is now stronger than ever since we united & solved the difficulties! Full details below👇

— Justin Sun (@justinsuntron) March 3, 2020

“Such actions are against every aspect of the core value of humanity & decentralization & sanctity of private property. We needed to act immediately to safeguard the #STEEM blockchain & ecosystem when we still had the chance,” he added.

But he remained somewhat optimistic, posting on Steemit, “This will be nothing but an exciting future.”

Anger, fury, and retribution

Later that same day, in Baja, Mexico, Steem community member Dan Hensley, an energetic 6’3” millionaire with slicked-back dark hair, woke up in his seafront house and saw the news on his phone. Hensley was not a witness but owned millions of Steem tokens and was hugely influential in the community.

He was shocked to see Sun had taken control of the blockchain and thought, “This is crazy. This is illegal. What is Sun doing?” he later told Decrypt.

What infuriated him was that his own tokens were being used against him. His tokens, thought to be held securely on Binance, were being used to vote him out. “They ended up using my Steem power—almost a million—and locked it up for weeks,” he recalled.

Other members of the community were similarly flabbergasted. “No one thought in a million years that would ever happen. That Binance would lock up its Steem for 13 weeks,” said Matt Rosen, co-founder of Steem’s most popular app, Splinterlands.

The next day, Hensley sat down at his desk overlooking the Pacific Ocean and fired up his gaming computer for a Zoom call. The chat, with Sun, his representative Roy Liu and members of the Steem community, had been organized to help repair relations among them.

It was during this discussion when Liu revealed that, contractually, Sun was free to do what he wanted with the ninjamined stake. There was nothing in the contract that said otherwise. The community argued he had been misled and that the money was for building out Steemit.

Sun chimed in. He explained that he saw Steemit as a venture capital investment. He wanted to invest in the project for the long term, grow the value of his tokens and sell them at a profit. He told the community, “I’m not interested in power at all, I just want to make money.”

Hensley appreciated the honesty, but was dismayed by Sun’s approach. After all, you can’t just buy a community.

But you can buy votes.

Fighting tooth and nail for a blockchain

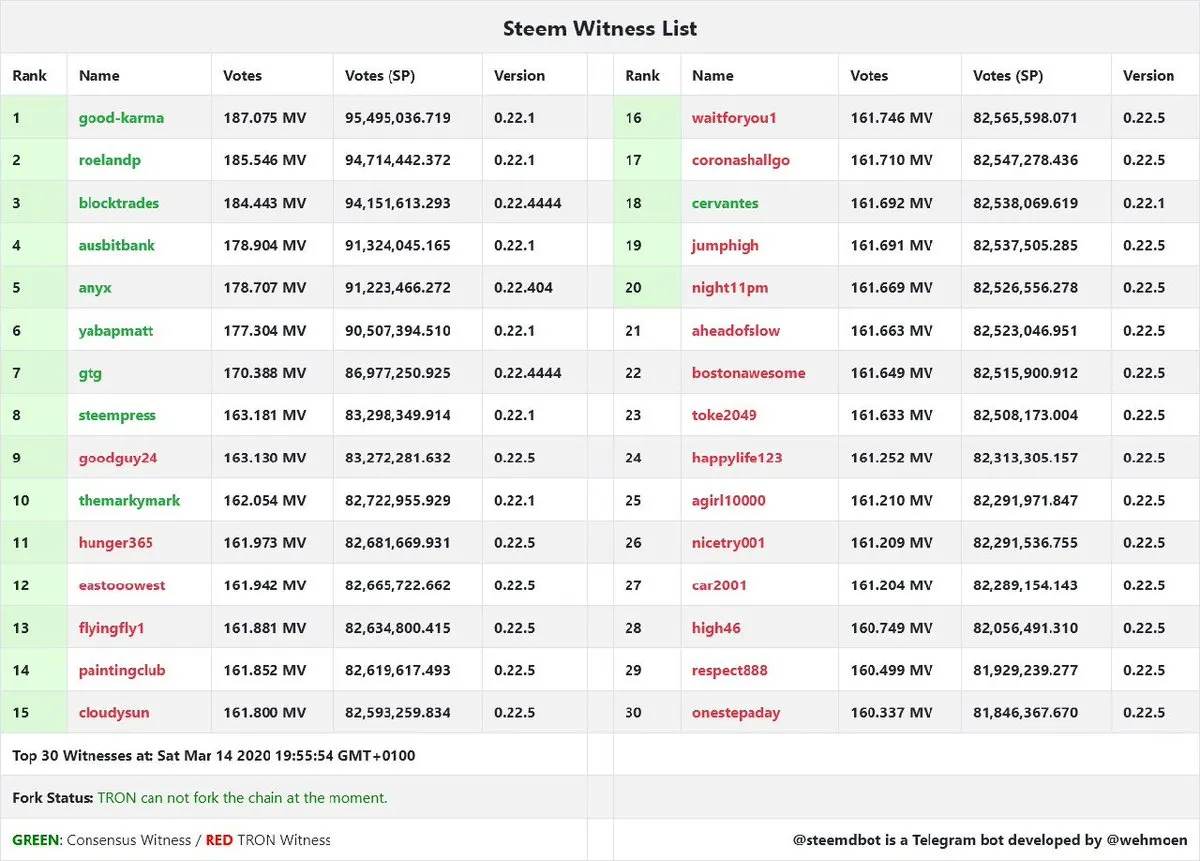

While negotiations were underway, Sun and the community wrestled over the Steem blockchain. The aim of the game was to control all of the top 20 witnesses—those with the most votes—because, together, they have full control over the blockchain.

Sun had freed the ninjamined stake and was now using it to vote for his 20 witnesses, keeping them in the top spots and giving him the starting advantage.

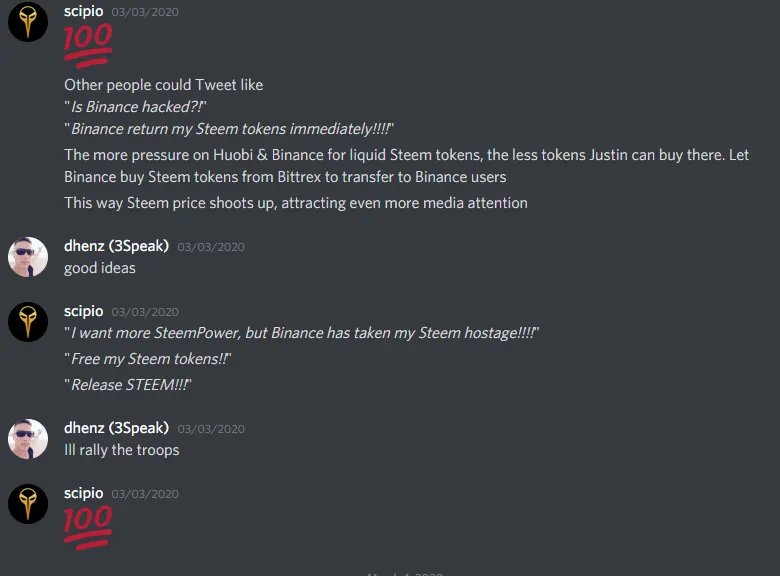

In return, Hensley rallied the troops. He marched around his room, speaking to community member “Acidyo” in his wireless headphones. They concocted a plan to mobilize Steem’s whales, who had millions of tokens, and get them to vote. He got on his computer and sent messages on Twitter, Discord, Steemit—even on the blockchain—to anyone sympathetic to the cause.

The plan: Get everyone voting for a few designated witnesses who were hostile to the Sun/Tron takeover.

On March 4, there was a breakthrough when Splinterlands’s Rosen, a long time witness, broke into the top 20. It nearly moved him to tears. Soon six more anti-Sun witnesses broke through. “I saw people who hated each other, they banded together. It was like an alien invasion, it was really amazing,” Hensley said.

"Do you like Justin Sun or you just want to fuck him?"

In a March 5 post on Steemit, Sun offered to vote for other witnesses so he could try to give back control over the blockchain to any community members that were on his side. He outlined 11 conditions for any that wanted his vote. But he was irascible: his questions read like complaints directed at the Steem witnesses who were defying him. One of his questions: “Do you like Justin Sun or you just want to fuck him?”

On March 7, Binance CEO Changpeng Zhao announced that his exchange would start powering down its funds, weakening Sun’s grip on the blockchain. There was a glimpse of hope. Hensley tweeted, “I think we're going to pull this off Steemians.”

I think we're going to pull this off Steemians.

— They Call Me Dan (@TheycallmeDan_) March 8, 2020

The next day, the community managed to get 10 of their witnesses into the top 20—splitting the vote evenly with Sun.

On March 9, Hensley tweeted, “UPDATE: We lost two spots last night, we're down to 8 now. Each day we have hit an ATH in voting for our #1 witness, approaching 94mil [Steem Power] now! No one said this will be easy, but we won't surrender & we're prepared for glory.”

During the voting war, Hensley spent $400,000 buying Steem tokens to boost the community’s voting power but each time he did, it would significantly bump the cryptocurrency’s price—making it more expensive to buy. On a call, Steemit’s managing director Elizabeth Powell told him that Sun was buying 300,000 Steem tokens ($60,000) a day, in response, to keep his witnesses at the top.

On March 15, Sun voted a newly created witness into the top 20 spots. A Steem witness tweeted that he had been a witness for four years and had 11,000 Steemians voting for him, while this new witness had just 29. At the end of the day, it was a stalemate again.

But Sun had one final trick up his sleeve. On March 16, he received a huge supply of 2.6 million Steem tokens ($520,000) from Binance. He used them to increase the votes for his top witnesses and take back control of the whole network.

“It was impossible to buy 4 million Steem at that time,” said Hensley. “That’s when we felt like it was a losing blow.”

But there was another way out.

Escaping to a new blockchain

On March 20, Notestein was back in his ranch home, tapping away in his semi-basement. Next to him were two developers coding the future of social media. Only this time, they were his own developers, and they weren’t building Steem—they were cloning it.

The nearly identical blockchain was called “Hive” and it would be used to build the social network that the community had always wanted. It would be censorship-free, with embedded cryptocurrency, and everything that made them love Steemit.

But there would be no ninjamined stake, no company controlling it and anyone who voted for Sun’s witnesses (largely Steemit's Korean community) would get no tokens. It was a fresh start.

And unlike the surprisingly premature launch of Steem, the developers were on hand to celebrate when the Hive blockchain—which had cost Notestein $500,000 to build—went live as scheduled, at 10 AM.

“Today a dedicated, decentralized community launched the Hive network in response to a centralized attack. I have no idea where token prices will go, but I'm so proud of those who put in the work to make this happen,” tweeted former Steem witness Luke Stokes.

3/20/2020

March 20th, in the year Two Thousand and Twenty.

Today a dedicated, decentralized community launched the #hive network in response to a centralized attack.

I have no idea where token prices will go, but I'm so proud of those who put in the work to make this happen.

— luke@stokes (@lukestokes) March 20, 2020

When the members of the Korean community saw the code, they realised that many of them had been left out. “We had less than 10 million Hive tokens that were distributed to the Korean community. And 4 million tokens erased from users who had voted for at least two witnesses from Tron,” an anonymous witness, who was part of the Korean community, later told Decrypt.

But the Steem community argued it was a new blockchain and they were free to give cryptocurrency out selectively. “It’s the difference between, you walk into a bank and you give out $100 bills to half the people there. That’s perfectly legal. It’s not legal to walk into a bank and take $100 from the other half of the people there,” said Andrew Hamilton, a lawyer and community member.

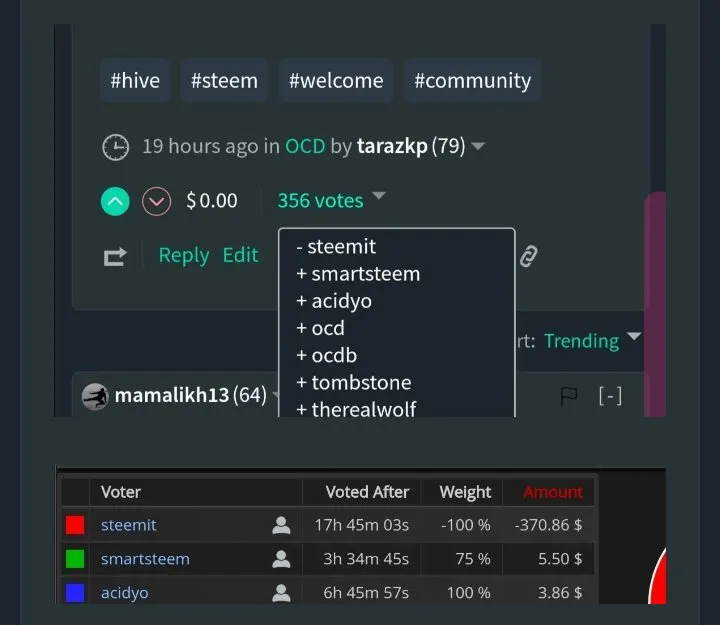

There was a backlash on Steemit too. The social network—largely run by Tron developers now since most Steemit team members had quit—changed the terms and conditions to forbid mention of any other network. The day after Hive launched, Sun downvoted a single post about Hive by so much that it showed as a $370 downvote (normally downvotes come to around $1) hiding it from view. Subsequently, any post about Hive was hidden from the site.

“It was pretty much everything Steem had stood for was destroyed overnight. It was supposed to be censorship-resistant and the company behind it was actively censoring,” said TheMarkyMark, a Steemit stalwart, with 25,930 posts to his name. “If you go to my feed, it’s empty. Everything I’ve worked for and done over the last three years has been erased.”

A heavy dose of vengeance

Now that Hive was built, some of those left behind on the Steem blockchain found themselves in a world of hurt.

While they had received new Hive tokens when it was launched, they were still in possession of their old Steem tokens. Most community members had already started powering down their tokens, getting a thirteenth of them back each week and selling them for Hive tokens. But during this process, their remaining funds were still at risk.

By April 2, Sun claimed that he had removed all of his witnesses, stating, “We will try our best to stay neutral and we will not engage with community decisions in the future.” Hensley laughed when he saw that because Sun’s funds were still keeping the new witnesses in place. Regardless of whether he was running them, he still controlled the blockchain.

On April 4, the Steem witnesses—representing Sun’s votes—froze eight accounts holding $3.2 million of Steem, including Notestein’s. Five of the witnesses had never made a single post on Steemit.

But it lit a fire under Hive. In the weeks that followed, Hive grew three times bigger than Steem, reaching a market cap of $234 million.

“Witness the rise of crypto anarchy! The most impressive part of this story is not the Proof of Stake power play by Sun. It's that those who dissented exited the network they considered compromised and created one that was EVEN MORE VALUABLE.” tweeted Casa CTO Jameson Lopp.

Crime and punishment

On May 19, the current Steem witnesses—still voted in by Sun, who continued to deny that he was playing a role—announced further retribution. The next upgrade would not just freeze accounts, but it would forcibly take cryptocurrency out of people’s accounts for supposed “criminal activity.” Some 23 million Steem tokens, worth $5 million and belonging to 65 accounts, were on the chopping block.

(2/4)I am not involved in this decision in any way, but as a member of the Steem community, I am entitled to my own opinions. Since Hive took the assets from the Steem witnesses, @vitalik & the misleading media have been 100% supportive of it.

— Justin Sun (@justinsuntron) May 20, 2020

Hensley was furious and reached out to some of the Korean witnesses whom he had met before, asking them how they could do this to him. Some of them later dropped out before the upgrade happened. By the time it went through, Hensley said he could only recognize two of the witnesses as real people; the others were likely fake.

Hensley stayed up all night and stared at the clock as the hour hand moved to 7 AM. He checked his Steem wallet. Then, just like that, his cryptocurrency was gone. He said he felt embarrassed because he was unable to stop his money from being taken in full view of the rest of the world.

“They didn't just steal my stake I spent over a million dollars on, they stole my time, my blood, sweat and tears,” he said.

Then he did a double take.

The tokens had moved. Not once, but twice. They were no longer sitting in the designated wallet, but had been sent to crypto exchange Bittrex with a message that the funds should be returned to their rightful owners.

The money was saved!

He tweeted, “Holy shit did someone just pull the most gangster white hat hack ever?”

The anonymous benefactor posted a picture of himself as fictional outlaw Robin Hood. When someone commented, asking what character would be used to play him if this was a movie, he replied, “I'd expect no less than Rami Malek, aka Elliot from Mr Robot,” referring to the cybersecurity engineer and vigilante hacker in the 2015 TV series.

Robin Hood also sent another transaction to Sun’s own Steem wallet with a message in Korean that said, “Stealing is bad.”

But Robin Hood didn’t quite save the day. Bittrex refused to hand the funds back to their original owners, putting them under review. On June 16, Notestein, Hensley and other witnesses filed a breach of bailment lawsuit—where property has been passed to a third person—against the exchange, in the US District Court for the Western District of Virginia. They hope to get their funds returned but it’s a long shot.

Looking ahead to the future

On July 8, Notestein was yet again in his basement. A whirring fan threatened to blow an empty Citrus Drops can off his desk. He had spent the last two days writing 3,000 words on the future of Hive and it was time to publish it, and see how the community responded.

“My vision is to make Hive the most attractive platform for the development of innovative, decentralized applications,” he wrote, before diving into the technical details.

It wasn’t just a pipe dream. Notestein had the technical expertise, a willing community and no obstacles in his way. The bomb that was the ninjamined stake had exploded, causing a difficult—and expensive—fallout, and obliterating a once thriving community.

But his dream for this social network was still very much alive.

Update: This article has been updated to clarify how the downvoting system works on Steemit.