Bitcoin’s price is up over 75% in the last month and almost 25% in the last week, to reach the $34,000 mark. The surging price combined with newly minted Bitcoin has resulted in a market capitalization of $638 billion.

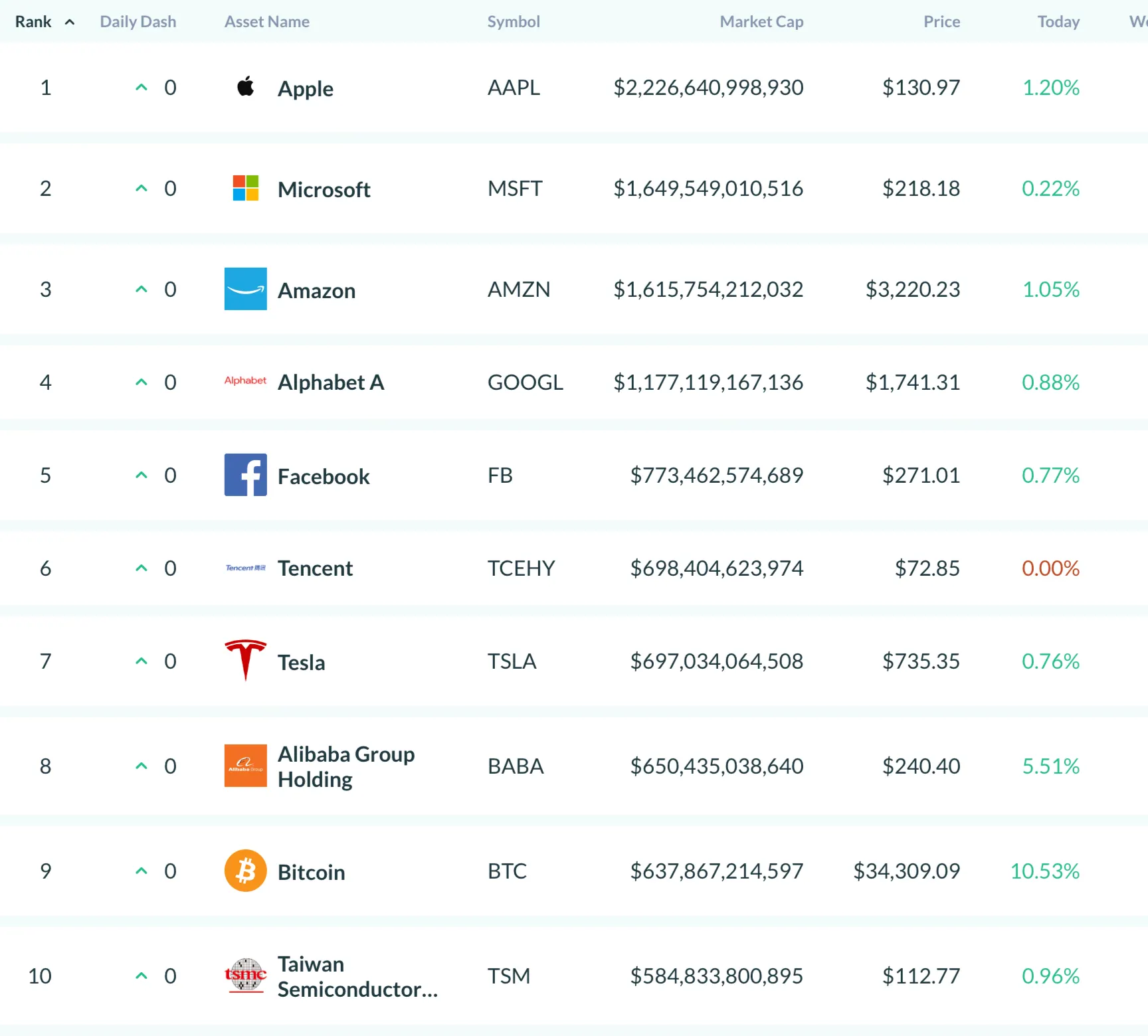

That’s good enough to make BTC the ninth-most-valuable asset in the world, according to Asset Dash, which tracks stocks, exchange-traded funds, and cryptocurrencies.

Fewer than two weeks ago, Bitcoin supplanted Visa on the list. Then, just five days later, it overcame a $70 billion deficit to overtake Berkshire Hathaway, the company run by Bitcoin detractor Warren Buffett. Since, BTC has also moved past shares in Taiwan Semiconductor Manufacturing.

Above Bitcoin is a murderer’s row of blue chip companies. Apple leads the way with a market cap of $2.23 trillion, followed by Microsoft ($1.65 trillion), Amazon ($1.62 trillion), Google parent company Alphabet ($1.18 trillion), and Facebook ($773 billion).

But spots 6 through 8 look ripe for the picking if Bitcoin can continue its upward momentum. Shares in Chinese conglomerate Tencent are worth $698 billion, Elon Musk’s Tesla commands a market cap of $697 billion, and Chinese tech firm Alibaba is worth $650 billion—just $12 billion more than BTC’s ever-adjusting market cap.

Bitcoin isn’t the only cryptocurrency asset making moves. Ethereum is now the 82nd-most-valuable asset, with a market capitalization north of $125 billion. That asset is up 50% in the last week, helping it recently pass financial services firm Morgan Stanley and the ubiquitous Starbucks.

Other cryptocurrencies in the top 1,000 include Tether (#475), Litecoin (#804), XRP (#812), Polkadot (#877), Cardano (#922), and Bitcoin Cash (#939).