In brief

- The decentralized finance world is made up of a multitude of decentralized, non-custodial financial products.

- They include decentralized exchanges, lending protocols and synthetic derivatives.

- DeFi is a highly experimental and risky niche within the wider cryptocurrency space.

Decentralized finance, or DeFi, sits at the white-hot center of the recent crypto bull run.

DeFi is crypto’s big thing at the moment, a little like how Initial Coin Offerings (ICOs) were all the rage back in 2017. Back in June 2020, just $1 billion was locked up in DeFi protocols, according to metrics site DeFi Pulse. By January 2020, "DeFi degens" had poured over $20 billion worth of cryptocurrencies into DeFi smart contracts.

What is DeFi?

So what is this powerful, wild beast known as DeFi? And isn’t all of crypto decentralized finance, anyway? Sort of. The DeFi movement refers to a specific genre of financial product that champions decentralization above all else, and uses lucrative incentive mechanisms to encourage investors to play along.

The decentralized finance world is made up of a multitude of non-custodial financial products, built around a culture of highly-experimental, highly-lucrative crypto projects that’s caught the eye of top companies and venture capitalists—and not a few scammers.

How does DeFi work?

Among the most popular projects are lending protocols Aave, Maker and Compound. These are protocols that let you borrow cryptocurrencies instantaneously—and often in large amounts if you can prove you can pay back the loan in a single transaction. You can also earn interest from lending out cryptocurrencies.

Then there’s Uniswap, a decentralized exchange that lets you trade any Ethereum-based token you like, or earn money if you add liquidity to that token’s market. DeFi’s also about synthetic assets, like Synthetix’s tokenized stocks or Maker’s decentralized stablecoin, DAI, whose value is algorithmically determined by the protocol. And other services port Bitcoin to Ethereum in a non-custodial manner or offer decentralized price oracles, which, among other things, allow synthetic assets to accurately peg themselves to their non-synthetic likenesses.

What earns these protocols the DeFi tag is that they are—at least in principle or ambition—decentralized and non-custodial.

Non-custodial means that the teams don’t manage your crypto on your behalf. Unlike, say, depositing your money in a bank or lending out your crypto with a crypto loans company (such as Cred), with DeFi protocols you always maintain control over your cryptocurrency.

Decentralized means that the creators of these protocols have devolved power over their smart contracts to the community—in the spirit of the hacker ethic, their creators vote themselves out of power as soon as possible and let the users vote on the future of the network.

The space has been known to fall short of its lofty ideals. In even some of the largest DeFi protocols, close readings of their smart contracts reveal that teams hold immense power or the contracts are vulnerable to manipulation.

But it’s wildly lucrative for some traders. Many of these lending protocols offer crazy interest rates, bumped up even higher by the phenomenon of yield farming, whereby these lending protocols offer additional tokens to lenders.

These so-called governance tokens, which can also be used to vote on proposals to upgrade the network, are tradable on secondary markets, meaning that some annual percentage yields work out at 1000%. (Of course, whether the protocols in question will last a whole year is up for debate).

What are some of the leading DeFi Protocols?

Decentralized lending protocols and yield farming

Aave, Compound and Maker are the major DeFi lending protocols, with billions of dollars of value locked up in their smart contracts. The premise is simple: you can loan out cryptocurrency tokens or borrow them. All the major protocols are all based on Ethereum, meaning that you can lend or borrow any ERC20 token. As mentioned above, they are all non-custodial, meaning that the protocols’ creators do not have control over your holdings.

Interest rates vary. At the time of this writing, you can lend out Maker’s decentralized stablecoin, DAI, for 7.75% on Compound, or borrow it for 10.78%%. On Aave, it’s 9.59% to lend and 17.46% to borrow. But the percentage points vary wildly each day, so take things with a pinch of salt.

These protocols sparked the so-called “yield farming” craze. In the middle of June, Compound came out with $COMP, a governance token that let holders vote on how the network would operate.

People who lent cryptocurrency on Compound would earn $COMP for their efforts—kind of like loyalty points. They could use these governance tokens to vote on proposals to upgrade the network. This was but one use for the token.

The other—one that brought fame and infamy to DeFi in equal measure—was to earn $COMP for speculative purposes. The stats explain why. On launch day, June 17, $COMP was worth $64. By June 23, a single $COMP was worth $346. Other lending protocol developers began to take notice and launch their own governance tokens. Aave has one, $LEND, as do a raft of other DeFi protocols.

Aave Governance is officially on mainnet, giving the decisional power to the community! Now it’s time to vote on the very first Aave Improvement Proposal (AIP) for the token migration from $LEND to $AAVE.

Thread on how to vote⬇️

Blog post for details: https://t.co/Z09ajBmb2Y

— Aave (@AaveAave) September 25, 2020

The cost of a single $YFI, the governance token for DeFi yield aggregator yearn.finance, peaked at $41,000 in the middle of September 2020, quadruple the price of Bitcoin at the time and close to its current all-time-high. (Granted, there are just 29,967 YFI in circulation at the time of writing, compared to 18 million-odd Bitcoin). And all this for a token introduced by yearn.finance’s creators as having “0 value.” They wrote upon launching the token: “Don’t buy it. Earn it.”

Decentralized exchanges and liquidity providers

Decentralized exchanges are another popular type of DeFi protocol. Uniswap is by far the largest. At the end of August 2020, daily trading volume on Uniswap hit $426 million, surpassing the volume of centralized exchange Coinbase, on which traders exchanged $348 million worth of cryptocurrencies. Others include Balancer, Bancor and Kyber. 1inch aggregates all of the decentralized exchanges on one website.

These exchanges are all examples of “automated market makers”. Unlike, say, centralized exchange Binance, or decentralized exchange IDEX, on which traders buy and sell crypto between each other, these automatic market makers have liquidity pools.

Let’s break that down: liquidity just means how easy it is to move money around a market. If a token’s market is highly liquid, it means that it’s very easy to trade. If it’s illiquid, it’s difficult to find buyers for your tokens.

Liquidity pools are big vaults of token pairings—say, a liquidity pool for ETH and BTC—that traders can draw upon to make trades. So, if someone has put $1 billion worth of ETH and $1 billion worth of BTC in a liquidity pool, there’s enough money running through the exchange for traders to trade the assets without any problems.

The DeFi part is that all of this is non-custodial, and any ERC-20 token can be added to these exchanges. This gives the market more choice, since centralized exchanges won’t list certain tokens due to legal qualms and because lots of tokens are, well, scams. The other DeFi part to this is the incentive structure. Those that bankroll these liquidity pools earn fees whenever someone makes a trade, in addition to various yield farming rewards dangled by some of the protocols.

Decentralized stablecoins and synthetic derivatives

This is what the centralized world of synthetic assets like: There is about $24 billion worth of Tether, the main US dollar-pegged stablecoin, in circulation. Tether claims that its tokens are entirely backed by cash reserves of the US dollar. But the answers to these claims lie behind closed doors, and the company has previously admitted that these tokens were at one point only 74% backed by the US dollar. The company is now under investigation by the New York Attorney General.

The exigent problem is that those trading such US dollar stablecoins must trust that the companies that create them are true to their word and that these tokens are always redeemable for US dollars. But companies betray their users’ trust; humans are fallible. Lawrence Lessig’s dictum, “Code is Law”, motivated the rise of the decentralized stablecoin, whose peg to the asset it represents is determined by a complex, self-sustaining algorithm. The most popular one is DAI, produced by Maker.

Synthetix is another popular synthetic asset platform. It lets people trade other derivative products, among them synthetic US dollars, Australian dollars, Bitcoin and gold. Stocks, ETFs and indices are all on the way.

A final synthetic asset is Wrapped Bitcoin, or WBTC. It works like this: Plug your BTC into its contracts, and WBTC will issue the equivalent in Bitcoin. The benefit is that Bitcoin users can join in on DeFi, which lives almost entirely on Ethereum.

WBTC has a market cap of about half a billion dollars. It is a custodial product—BitGo, a Goldman Sachs-backed crypto prime brokerage firm based in Silicon Valley, holds custody over this Bitcoin. Non-custodial products are on the way.

How to get started with DeFi

So you want to try this DeFi thing out? Here’s what you need to do.

First, get a wallet that supports Ethereum and can connect to various DeFi protocols through your browser. MetaMask is a common choice.

Second, buy the relevant coin for the DeFi protocol you plan to use. Right now, most DeFi protocols live on Ethereum, so you’ll have to buy ETH or an ERC-20 coin to use them. (If you want to use Bitcoin, you’ll have to exchange it for an ETH version of Bitcoin, like Wrapped BTC).

Third, play the DeFi game. There are innumerable ways to do so.

One way is to lend out your cryptocurrencies. An easy way to see how to get the best deal is to use yearn.finance, which lists them in one simple place. You could become a “yield farmer” by earning the governance tokens that are awarded for lending out your cryptocurrencies. More information on potential profits from yield farming can be found on sites like yieldfarming.info.

A second way to play would be to put your funds in a decentralized exchange, such as Uniswap, and earn fees by becoming a market maker. You could even put them in the controversial Uniswap rival SushiSwap, which allows you to earn yield-farming tokens on your market making.

Third, you could invest in one of the highly experimental, crazier DeFi projects, like Based.Money, whose token price “rebases” daily, skewing the price of the token, or the popular variety of volatile meme coins, such as $YAM, $TENDIES, $KIMCHI, $SHRIMP, and so on.

But one thing to keep in mind: The space is full of risks, scammers and errors. This is a highly experimental and risky space within crypto, which is itself a highly experimental and risky space. Fraudsters, exit scammers and "rug pulls" are rife, and people often discover vulnerabilities in smart contracts that reveal how the token creators hold all the power (and the project is not decentralized at all, after all). Be careful.

How to use a decentralized exchange

One of the most popular DeFi platforms is Uniswap, a decentralized exchange. Work out how to trade on Uniswap and you're in, primed to handle most anything DeFi developers can throw at you. Here's a quick guide to getting started. We'll keep things simple and just show you how to perform a simple exchange, in this case ETH for DAI, a decentralized stablecoin.

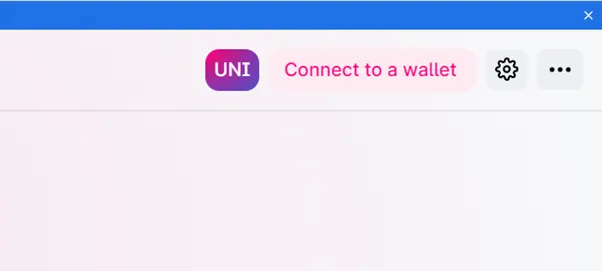

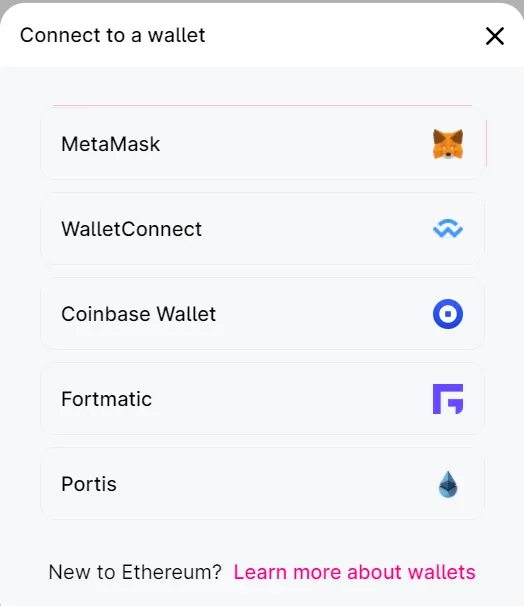

First, we want to send our ETH, which we have already purchased from Binance, to Uniswap. To do that, we'll first have to connect a wallet. We're going to use MetaMask, a popular browser wallet that's compatible with most DeFi applications. To do so, we go on Uniswap and click "Connect to a wallet" on the top right of the site (through a desktop browser).

Then, click MetaMask.

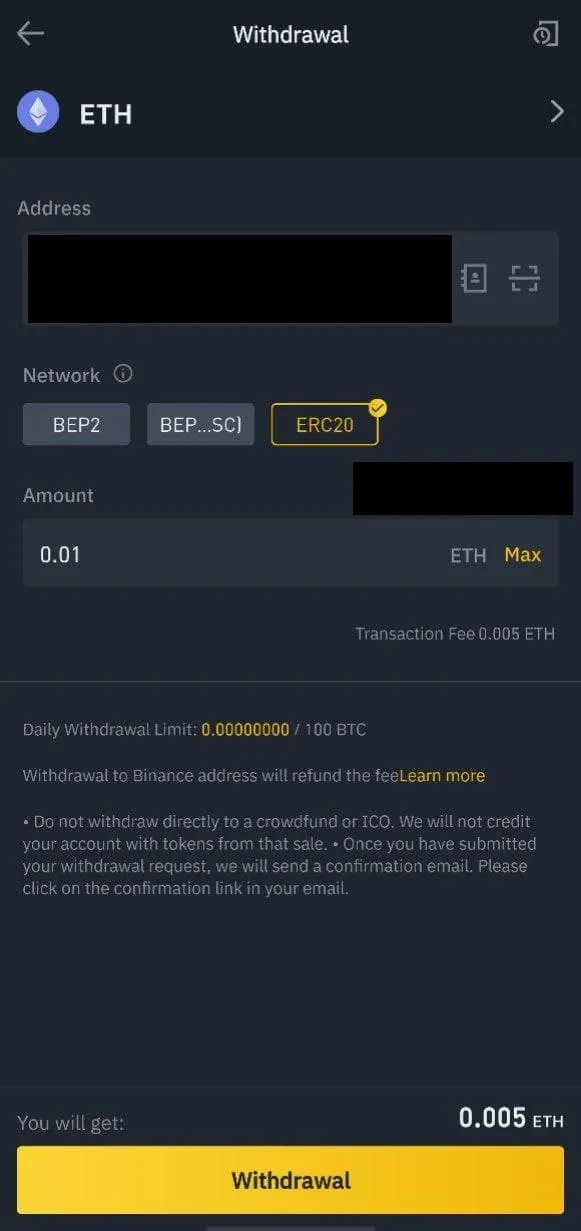

Once you're all set up, you should have a wallet address in MetaMask. So, you'll need to send some Ethereum to that MetaMask address from wherever you're holding your ETH.

Ours is on Binance, so we'll send some. We sent $5, then $20, to MetaMask. Here's one of those transactions. Note that you must pay a transaction fee. To send $25 in ETH from Binance to MetaMask in two transactions, we paid $11. These "gas fees" have soared amid high demand, as Ethereum's price has risen and DeFi applications have taken off.

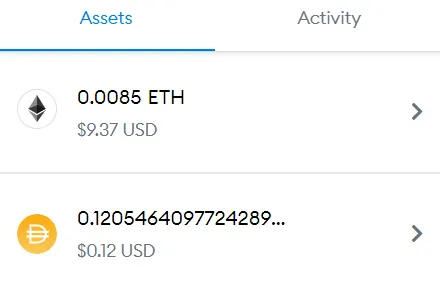

Here's what that looked like. The transaction took a few minutes to arrive at our MetaMask address—blockchains are slow. With what remains of our ETH in hand, let's transfer ETH to DAI.

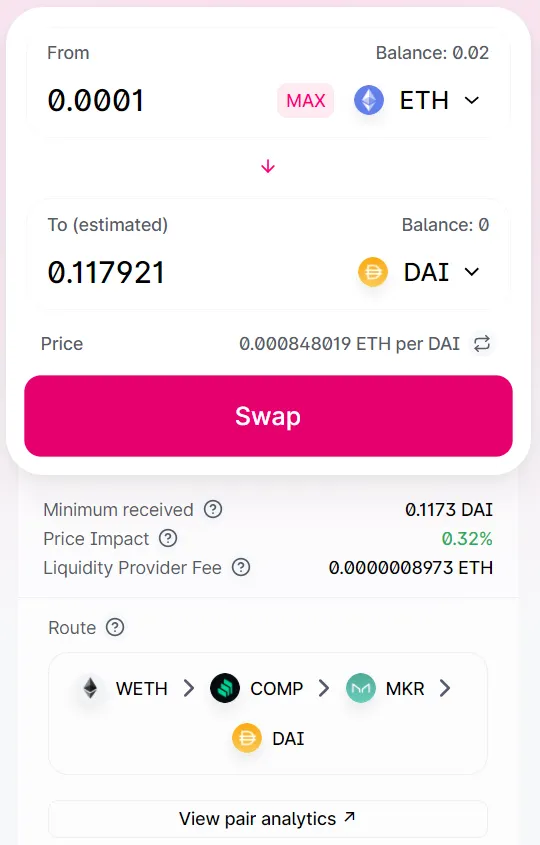

For the purposes of this article, let's keep it simple and exchange 0.0001 ETH for 0.117 DAI. That's the equivalent of $0.117, since DAI is pegged to the US dollar. Do so so, we'll click on swap, then select ETH and DAI from the list. We'll pay liquidity providers—the people who have plonked down pairings to facilitate this transaction—a small fee. And Uniswap has determined that the cheapest way to make this transaction happen is to swap from ETH to WETH to COMP to MKR to DAI.

Excellent. So, click swap and open up your MetaMask address.

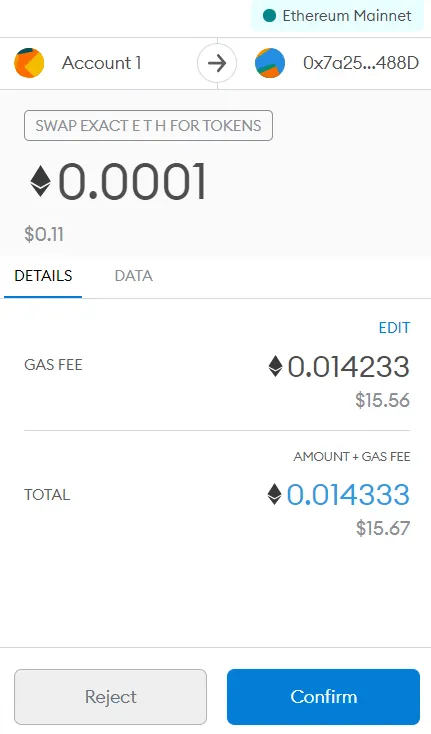

Eek. This transaction costs $15.67, since we have to pay miners on Ethereum to process this transaction. Ethereum's gas fees change all the time. On busy days, they're sky-high. On slower days, they're as low as a few dollars. But, in the name of education, let's confirm this transaction.

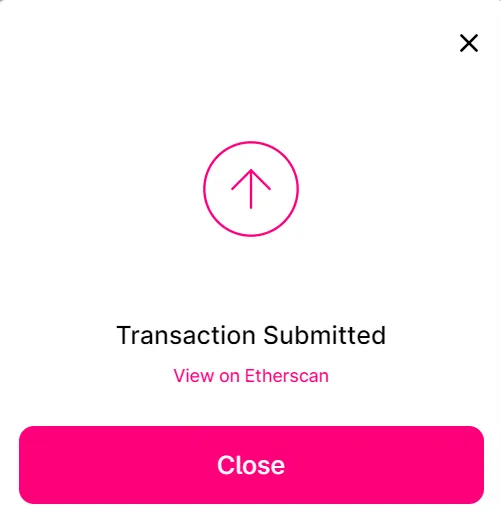

Our gentleman's agreement has been submitted, ready for validation from Ethereum miners.

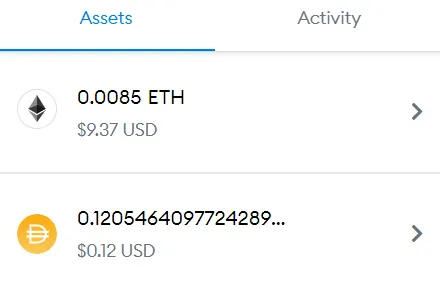

And there it is! Our purchase of DAI confirmed on the blockchain and ready for use.

The beauty of DeFi. And it only cost $25 to transfer $0.12! A veritable bargain. But how pretty it looks.

Then we transferred our ETH back to its snug home on Binance. Another $1.5, making our exchange a total of $26.5. This trade would have cost next to nothing if we traded it within Binance. But now, our $0.12 is ready to go toward any DeFi protocol, ready for that sweet, sweet yield. If we deposit enough ETH to pay the gas fee, that is.

The future of DeFi

Few predicted the dramatic rise of DeFi, and fewer still can predict its future. There are a few obvious directions where it might go.

The industry will expand to more blockchains

As of September, Ethereum is the home to all the major DeFi projects. But other blockchains are building projects. A few things will likely occur.

The first is that DeFi projects will become more interoperable. Bitcoin can already be used on Ethereum in the form of Wrapped BTC, and more initiatives to enable cross-blockchain compatibility are in the works, most notably Tendermint’s Cosmos, additional work by Ren and the Polkadot project.

Second, DeFi will expand to other blockchains. Once the domain of Ethereum, other blockchains are eying up DeFi. Huobi, Conflux, Binance and others are all launching incubators and platforms for DeFi projects, many of which have no connection to Ethereum.

Third, DeFi will interact with centralized finance. What if your credit score could be linked to a decentralized lending protocol? What if you could stake your house as collateral for a crypto loan? What if your high-street bank let you buy and hold decentralized stablecoins? All these are in the works. The job market could surge, and institutional investors could pour money into its protocols. The operative word there being “could”.

Itamar Lesuisse, co-founder and CEO of DeFi-friendly crypto wallet Argent, told Decrypt in July 2020 that this “early experiment” is “just the start. He said: “In the years ahead we look forward to it solving significant problems for mainstream users around the world; we'd argue the user experience is already better than traditional finance in many areas.”

Jason Wu, CEO and cofounder of DeFiner, told Decrypt that DeFi projects will attract lots of capital. “With the raised capital, DeFi projects can build more applications and fit the demand and build next generation financial networks,” he said.

There’s a fourth, less certain question: are we in a DeFi bubble, and is this sustainable?

Vitalik Buterin, the co-founder of Ethereum, warned at the end of August 2020 that the current DeFi craze is not sustainable. “Seriously, the sheer volume of coins that needs to be printed nonstop to pay liquidity providers in these 50-100%/year yield farming regimes makes major national central banks look like they're all run by Ron Paul,” he tweeted, raising the specter of the Republican Congressman who called for the end of the Federal Reserve.

Seriously, the sheer volume of coins that needs to be printed nonstop to pay liquidity providers in these 50-100%/year yield farming regimes makes major national central banks look like they're all run by Ron Paul.

— vitalik.eth (@VitalikButerin) August 31, 2020

In a since-deleted tweet in September 2020, Ryan Selkis, founder of crypto data analytics firm Messari, said, “We're nearing the apex of ponzi economics, rug pulls, and "yield" hopping, and ETH fees are going to eat too heavily into non-whale profits.” He continued: “DeFi is just one big pool of capital sloshing around a small group of insiders and mercenaries who will soon run out of victims to fleece.”

Others think that should the “bubble” pop, the DeFi space will continue to grow, albeit the profits from things like yield farming will be smaller. Changpeng "CZ" Zhao, CEO of crypto exchange Binance, tweeted in September that he sees “lots of bubbles in DeFi now,” but that he believes “the core concept of "staking coins to provide liquidity and earning a return" will stay. But these super high yield returns subsidized by new tokens won't.

(Un)popular opinion: I see lots of bubbles in #DeFi now.

I believe the core concept of "staking coins to provide liquidity and earning a return" will stay. But these super high yield returns subsidized by new tokens won't.

Super high risk. Be cautious!

— CZ 🔶 Binance (@cz_binance) September 1, 2020

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.